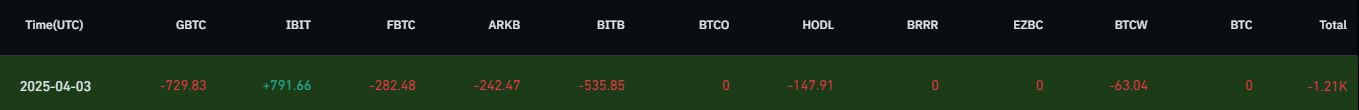

On April 3, 2025, significant outflows were observed in Bitcoin ETFs and Ethereum ETFs. The latest data shows that investors have made substantial sales in certain ETFs.

Bitcoin ETFs See Big Movement

The most notable outflow in the Bitcoin ETF market occurred in Grayscale’s GBTC fund, with 729.83 BTC exiting on a daily basis. Bitwise’s BITB ETF also saw an outflow of 535.85 BTC. Meanwhile, BlackRock’s IBIT ETF continued to attract investor interest with an inflow of 791.66 BTC. Overall, Bitcoin ETFs experienced a total outflow of -1.21K BTC.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

- GBTC: -729.83 BTC

- IBIT: +791.66 BTC

- FBTC: -282.48 BTC

- ARKB: -242.47 BTC

- BITB: -535.85 BTC

- BTCW: -63.04 BTC

- Total: -1.21K BTC

This data shows that investors are flocking to BlackRock’s IBIT ETF, but overall, there is a selling pressure in the market.

Ethereum ETFs See Sharp Decline!

In Ethereum ETFs, Bitwise’s ETHW ETF saw an outflow of 2.01K ETH. No other Ethereum ETFs saw any significant inflows or outflows.

- ETHW (Bitwise): -2.01K ETH

- Other ETH ETFs: 0 ETH inflows/outflows

- Total: -2.01K ETH

This outflow highlights the declining investor confidence in Ethereum ETFs, showing lower interest compared to Bitcoin ETFs.

The latest data shows that while Bitcoin ETFs like IBIT are seeing inflows, overall, the market is facing a selling pressure. Meanwhile, Ethereum ETFs are stagnant, with Bitwise’s ETHW ETF’s outflow raising concerns.

Investors are closely monitoring macroeconomic developments in the US and the SEC’s Ethereum spot ETF approval process. How the market will evolve in the coming days remains to be seen!

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.