Although Bitcoin’s correlation with traditional stocks has decreased, the supply of fiat money remains a key factor influencing Bitcoin’s price.

The changing relationship between Bitcoin and traditional financial markets is under pressure as global investors shy away from riskier assets, and trade tensions between the U.S. and other countries escalate.

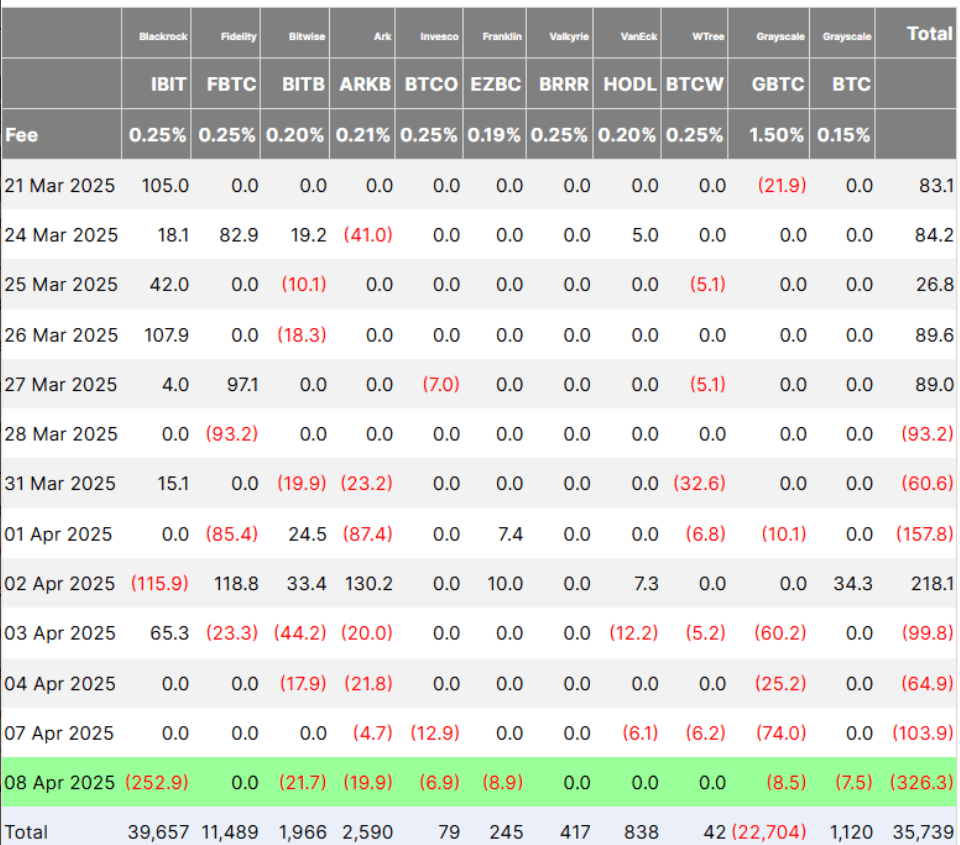

On April 8, U.S.-listed spot Bitcoin (BTC) exchange-traded funds (ETFs) saw net outflows of over $326 million, marking the fourth consecutive day of significant selling. These data were provided by Farside Investors.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) experienced the largest daily outflow, with $252 million, the biggest since February 26. The source of the selling pressure was the market turbulence that followed U.S. President Donald Trump’s announcement of reciprocal import tariffs on April 2. This development caused a $5 trillion wipeout in the S&P 500 within just two days.

Bitcoin ETF flows, U.S. dollars, millions. Source: Farside Investors

The crypto market turmoil following the tariff announcement highlighted once again the “emerging relationship” between Bitcoin and traditional markets. Lennix Lai, the global commercial director of OKX exchange, commented:

“Although Bitcoin has dropped by 26% since January, the relative resistance shown in the first two days after the tariff announcement— a 6% drop compared to Nasdaq’s 11% drop— reveals a subtle dynamic between crypto and traditional assets.”

Bitcoin, initially holding above $82,000, fell below $75,000 on Sunday, April 6.

Some industry leaders suggested that the weekend sell-off was related to Bitcoin’s 24/7 liquidity mechanisms, which made Bitcoin the only major liquid asset during the weekend. Bitcoin continues to be tightly linked to global liquidity conditions. Lai also stated:

“While I saw some divergence in the early stages, I believe Bitcoin is still dependent on global liquidity conditions, which means caution should be exercised considering potential market stress. Meanwhile, gold continues to serve as a hedge against geopolitical instability.” Lai added, “The most important thing here is not just the price movement but also Bitcoin’s growing conceptual impact — more and more people see Bitcoin as a strategic reserve asset in the chaotic environment of traditional markets.”

Other analysts also consider increasing fiat money supply as the main determinant of Bitcoin’s price.

“Bitcoin is traded based on the market’s expectations regarding the future supply of fiat money,” said Arthur Hayes, co-founder of BitMEX and chief investment officer at Maelstrom.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.