Despite notable outflows, crypto exchange-traded funds (ETFs) remain a dominant force in the ETF market, outshining over 400 new ETFs in 2024. The four biggest ETF launches this year have all been spot Bitcoin ETFs.

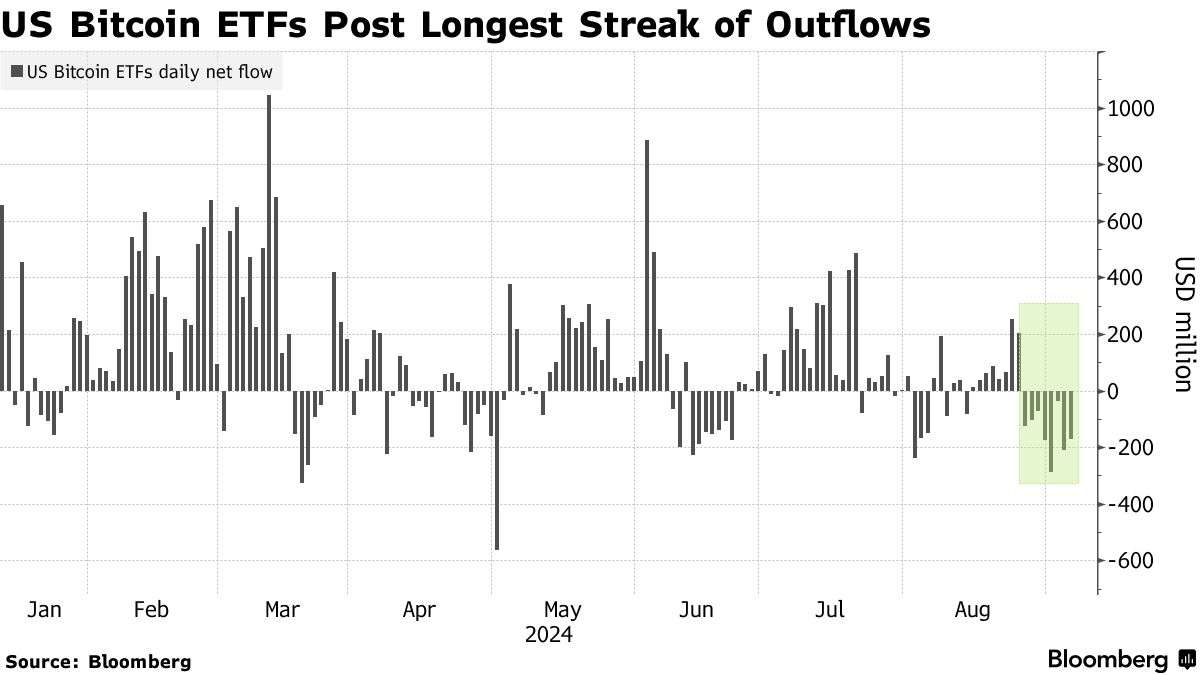

Data from Bloomberg on September 9 revealed that 11 U.S.-based spot Bitcoin ETFs experienced a combined net outflow of $1.2 billion between August 30 and September 6. This marks the longest streak of outflows since these ETFs launched on January 10.

Bitcoin Price Struggles Amid ETF Outflows

The outflows coincided with Bitcoin’s recent price struggles. From a high of $64,668 on August 26, the price fell to $53,491 by September 7, representing a 17.28% decline in just two weeks. Analysts have noted that Bitcoin historically performs poorly in September, a month often referred to as “Rektember” due to its reputation for market downturns.

However, despite the short-term dip, many experts remain optimistic about Bitcoin’s future prospects. Financial advisor Suze Orman, for instance, believes Bitcoin remains a key investment for the next generation. In a CNBC interview, Orman emphasized that as younger investors accumulate wealth, Bitcoin will likely become a preferred asset, pushing its value higher in the long run.

Might interest you: U.S. Bitcoin and Ethereum ETFs Hit Multi-Month Lows

Crypto ETFs Dominate 2024 Launches

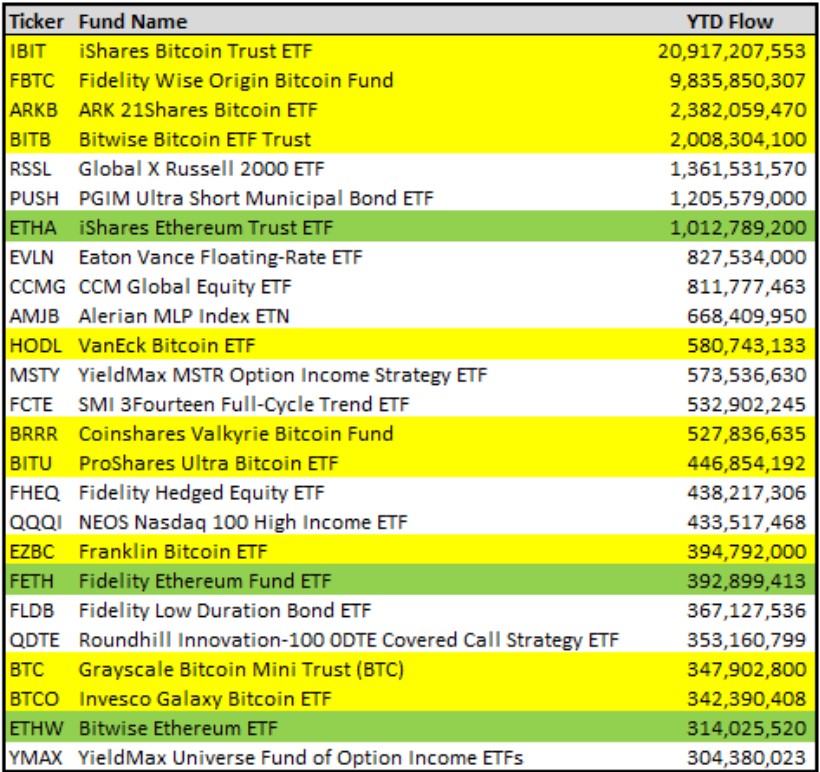

While Bitcoin ETFs have seen outflows, crypto-related ETFs have been the standout success stories of 2024. According to data from The ETF Store, the four biggest ETF launches this year have been spot Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust, Fidelity’s Wise Origin Bitcoin Fund, the ARK 21Shares Bitcoin ETF, and Bitwise’s Bitcoin ETF Trust.

Of the top 25 ETF launches by inflows in 2024, 13 are crypto-related, with 10 focused on Bitcoin and three on Ethereum. Notably, the iShares Ethereum Trust ETF surpassed $1 billion in inflows by August, making it the seventh-largest ETF launch of the year.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.