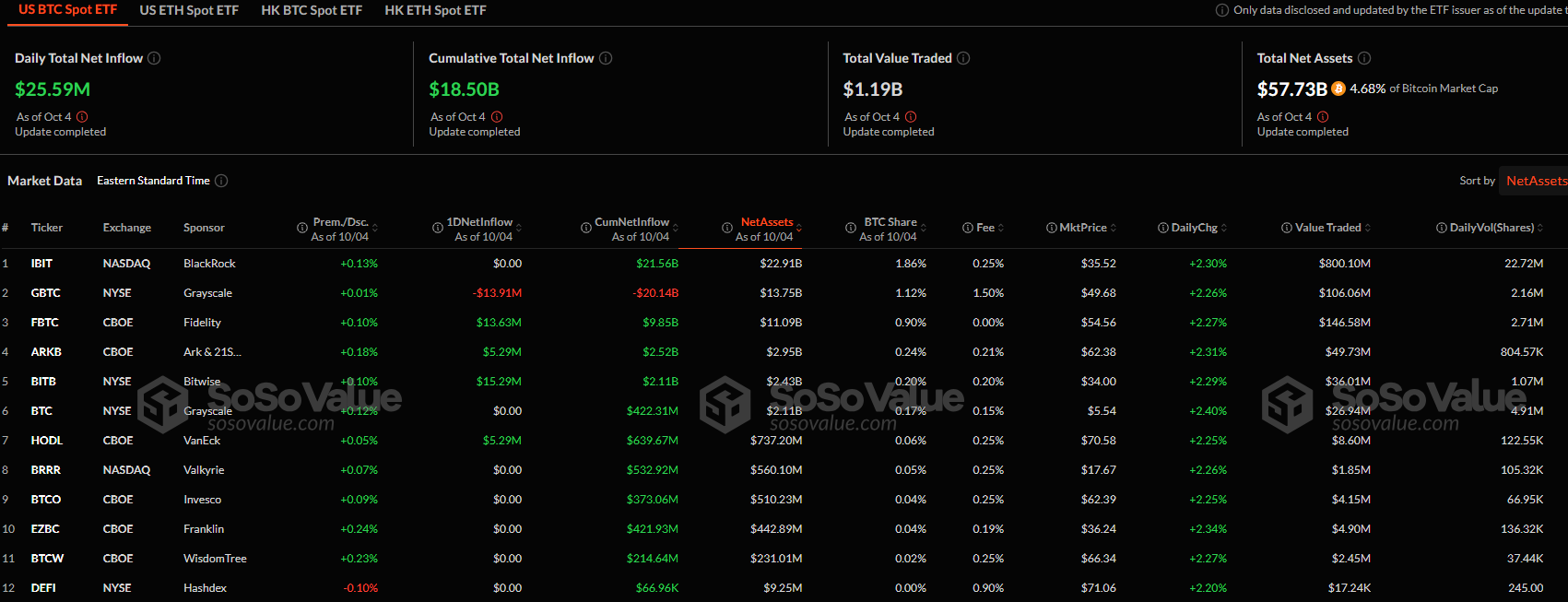

On Friday, US-based spot bitcoin exchange-traded funds saw a meager daily flow; nonetheless, they completed the week with a net negative outflow for the first time since Sept. 6.

From $61.21 billion on Sept. 27, one week ago, to $57.73 billion after the week’s outflows and bitcoin’s drop in value from roughly $65,000 on Friday the 27th to roughly $62,000 on Friday, Oct. 4th, the total net assets kept by the funds have dropped.

Based on SoSoValue data, Friday’s funds had a small daily net inflow of $25.6 million—led by a $15.3 million infusion to Bitwise’s BITB fund. With $13.6 million, Fidelity’s Facebook TC logged the second-highest inflow; VanEck’s HODL and Ark & 21Shares tied with $5.29 million.

İlginizi Çekebilir:

Recently, Bitwise revealed its intentions to overhaul its three crypto futures exchange-traded funds by using Treasury bonds in an effort to reduce volatility. Bitwise Chief Information Officer Matt Hougan said in a statement, “The goal is to help minimize downside volatility and maybe improve risk-adjusted returns.”

With an outflow of $13.9 million on Friday, Grayscale’s GBTC was the sole fund with which to report outflows. The other money recorded no notable inflows or outflows.

Based on SoSoValue statistics, Ethereum ETFs closed the week with a net-negative outflow of $30.7 million, even though Friday’s daily inflow was just $7.4 million. BlackRock’s ETHA fund, which registered $14.7 million worth of inflows, drove Friday’s flows. Bitwise’s ETHW recorded $871,000 worth of inflows as well; no other fund observed noteworthy inflows.

Along with ether’s price drop from over $2,700 on the 27th to roughly $2,400 on the Oct. 4th, offsetting the inflows were $8.2 million in outflows from Grayscale’s ETHE fund. BlackRock’s spot Ethereum fund exceeded $1 billion in net asset value last week; nevertheless, the fund dropped back below that level this past week. SoValue data indicates that it now has assets of $987.6 million.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.