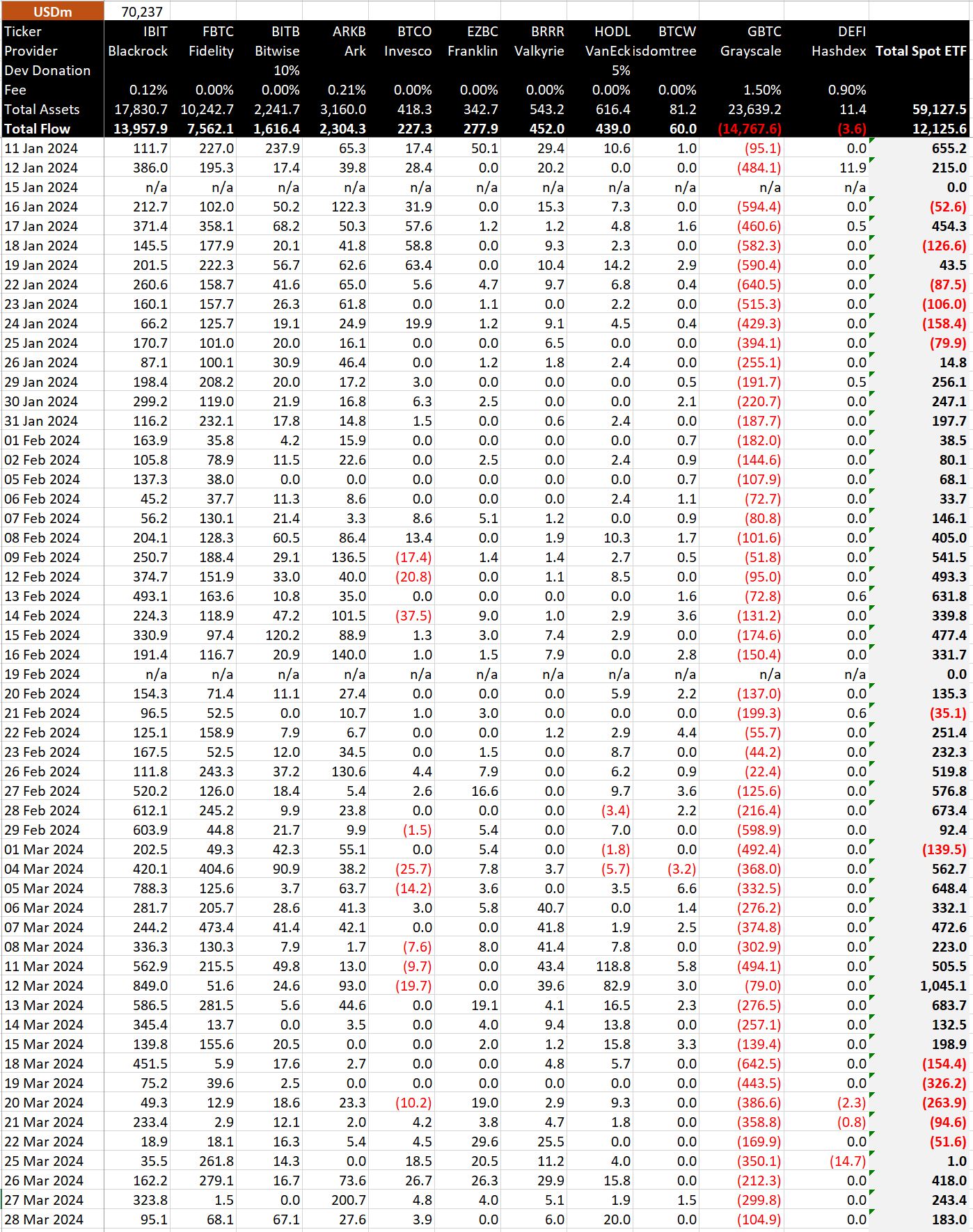

Bitcoin exchange-traded funds (ETFs) continue to attract investor interest, recording their fourth consecutive day of net inflows on March 28th. According to BitMEX data, the total net inflow reached $183.0 million, representing 2,587.9 BTC.

Grayscale Bitcoin Trust (GBTC) Sees Easing of Selling Pressure

While the Grayscale Bitcoin Trust (GBTC) experienced outflows of $104.9 million (1,482.8 BTC), this figure marks the smallest outflow since March 12th. This suggests a potential slowdown in selling pressure for GBTC. Despite these outflows, BitMEX data indicates that GBTC has seen a total of $14.7 billion in outflows (283,937 BTC) year-to-date.

Strong Inflow Days for Bitwise and VanEck ETFs

Other Bitcoin ETFs enjoyed significant inflows. Bitwise ETF (BITB) had a particularly strong day, attracting $67.1 million (949.3 BTC), its highest daily inflow since March 4th. Bitwise has now accumulated a total of $1.6 billion in inflows (31,749 BTC).

The VanEck ETF (HODL) also saw a surge in inflows, reaching $20 million (283 BTC), its best day since March 12th. HODL has now amassed a total of $439 million in inflows (7,125 BTC).

Overall Positive Trend for Bitcoin ETFs

BitMEX data reveals a total net inflow of $12.1 billion for Bitcoin ETFs, representing 212,852 BTC. This positive trend suggests growing investor appetite for Bitcoin exposure through regulated exchange-traded funds.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.