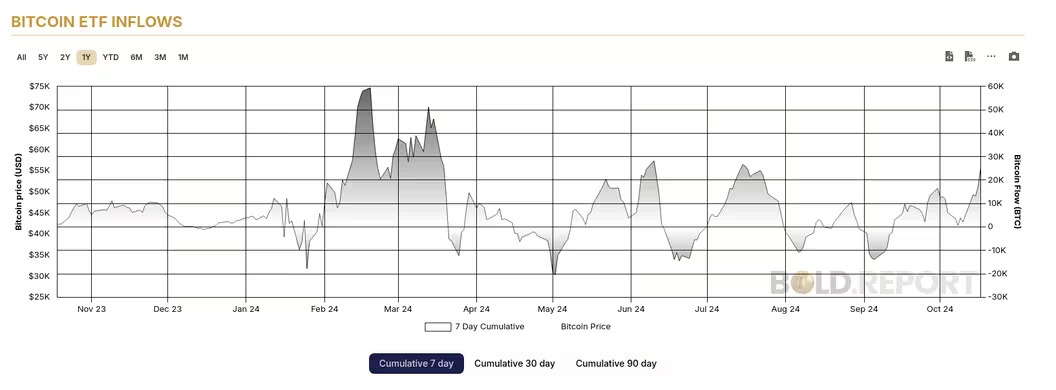

Bitcoin exchange-traded products (ETPs) have seen significant inflows over the past week, marking the largest seven-day inflow since July 2024. Global ETPs have accumulated 25,675 BTC, equivalent to $1.74 billion, during this period. This surge in inflows is driven by renewed investor interest, with Bitcoin (BTC) gaining around 15% since its lows on October 10, bringing it just 8% shy of its all-time high in March.

Since October 14, U.S.-listed spot Bitcoin ETFs alone have attracted approximately $1.9 billion (21,450 BTC) in net inflows. To put this into context, Bitcoin ETF investors have effectively bought the equivalent of 48 days’ worth of newly mined Bitcoin, considering that around 450 BTC are mined daily.

This marks a significant milestone for Bitcoin ETPs, which now collectively hold around 1.1 million BTC, matching the amount in Satoshi Nakamoto’s wallet. Notably, the rapid growth of Bitcoin ETFs surpasses that of gold ETFs, which took five years to reach $20 billion in inflows—a milestone Bitcoin ETFs reached in under a year.

Might interest you: What is BabyDoge?

Additional factors contributing to Bitcoin’s resurgence include expectations of potential Federal Reserve rate cuts and rising optimism surrounding Donald Trump’s pro-crypto stance as the U.S. presidential election approaches. Ether (ETH) has also seen substantial inflows, with $48.4 million netted on October 17, the highest since September 27.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.