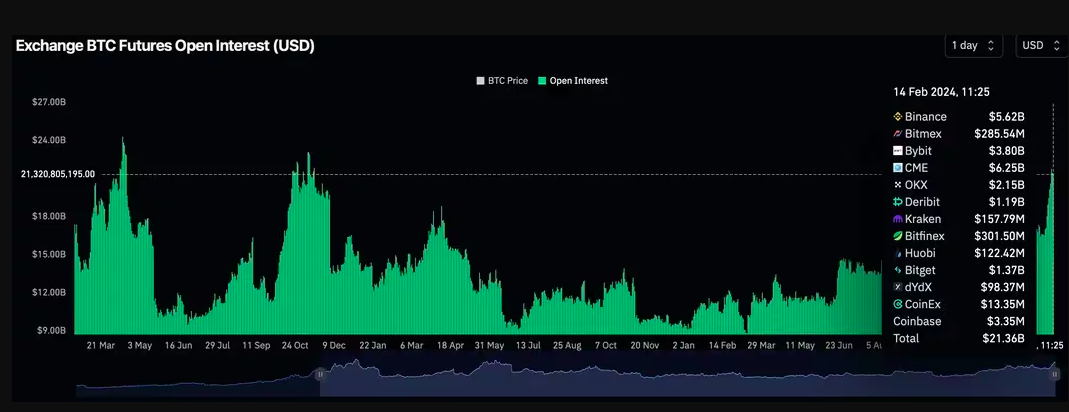

Attention crypto traders! Bitcoin futures are flashing bullish signals, with the amount of money locked in these contracts hitting a 26-month high of over $21 billion. This suggests there’s new money flowing in, betting on further price increases.

You might like: Solana’s market cap overtakes BNB, secures 4th position

But hold on to your hats before cranking up the leverage. While the numbers are rising, experts say the overall use of leverage in the market is still relatively low. This means that even though more people are placing bets, they’re not going all-in with borrowed money.

Remember, leverage works both ways. It can magnify your profits, but also your losses. A sudden surge in leverage could lead to dramatic price swings, especially if things head south.

Luckily, that doesn’t seem to be the case right now. While the estimated leverage ratio for Bitcoin has risen slightly, it’s still far below the levels seen in 2022. Additionally, the number of open futures contracts (measured in actual Bitcoins) is way below its peak, showing a cautious approach despite the bullish sentiment.

“The excitement is there,” says Noelle Acheson, a crypto expert. “But people are playing it smart this time.”

So, the takeaway? Bitcoin futures are hinting at a possible bull run, but don’t get carried away with leverage. Remember, responsible trading is key in the volatile world of crypto.

Feel free to share your thoughts on the topic in the comments. Besides, don’t forget to follow us on Telegram, YouTube, and Twitter for more analysis and updates.