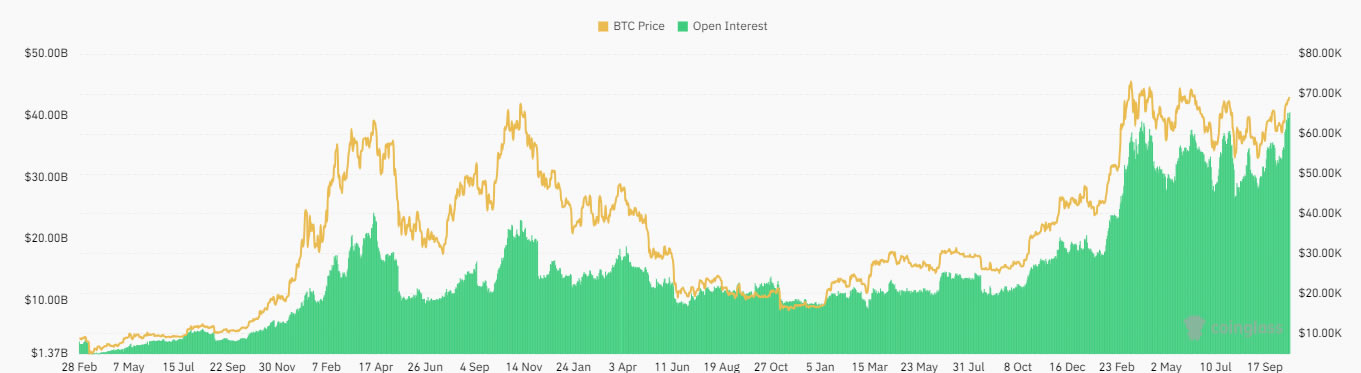

Bitcoin open interest on futures contracts has surged to over $40 billion, marking a record high as the cryptocurrency flirts with the $70,000 price mark. Open interest (OI) reflects the number of outstanding futures contracts that have yet to expire, signaling significant leverage in the system. With $40.5 billion in OI as of October 21, the Chicago Mercantile Exchange (CME) leads the market with 30.7% of the share, followed by Binance and Bybit.

High OI typically suggests increased leverage in the market, which can amplify price volatility. If prices move sharply, it could lead to cascading liquidations, triggering rapid sell-offs and sharp price drops in what is known as a “flush out.” A notable example of such a flush-out occurred in August when Bitcoin’s price dropped by 20% within two days, falling below $50,000.

Might interest you: What is BabyDoge?

On October 21, Bitcoin hit a high of $69,380 before pulling back to around $69,033. While Bitcoin is just 6.4% shy of its all-time high of $73,738, it faces resistance at the $70,000 mark. If Bitcoin breaks above this key level, it could spark rallies in other cryptocurrencies, such as Ethereum and Solana, both of which have been outperforming Bitcoin in terms of daily gains recently.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.