The upcoming Bitcoin halving in April 2024, a highly anticipated event that reduces the amount of new BTC entering circulation by half, is casting a long shadow on the cryptocurrency’s price movements. While some whales accumulate, others sell, creating a complex picture for price predictions.

Accumulations and Sell-offs Signal Different Strategies:

- Grayscale, a major investment firm, continues selling: Recent data shows Grayscale depositing large amounts of Bitcoin into Coinbase, suggesting a continuation of their sell-off strategy. This could put downward pressure on prices in the short term.

- MicroStrategy, a software company, remains bullish: In contrast, MicroStrategy has been actively buying Bitcoin, adding 850 BTC to their holdings recently. This indicates their long-term confidence in the asset and could create buying pressure.

- Whales accumulate at 10-month high: The number of Bitcoin whales (entities holding over 1,000 BTC) has reached a 10-month high, suggesting increased confidence and accumulation among large investors. This could be a positive sign for future price movements.

Bitcoin Halving: Technical Indicators Show Mixed Signals

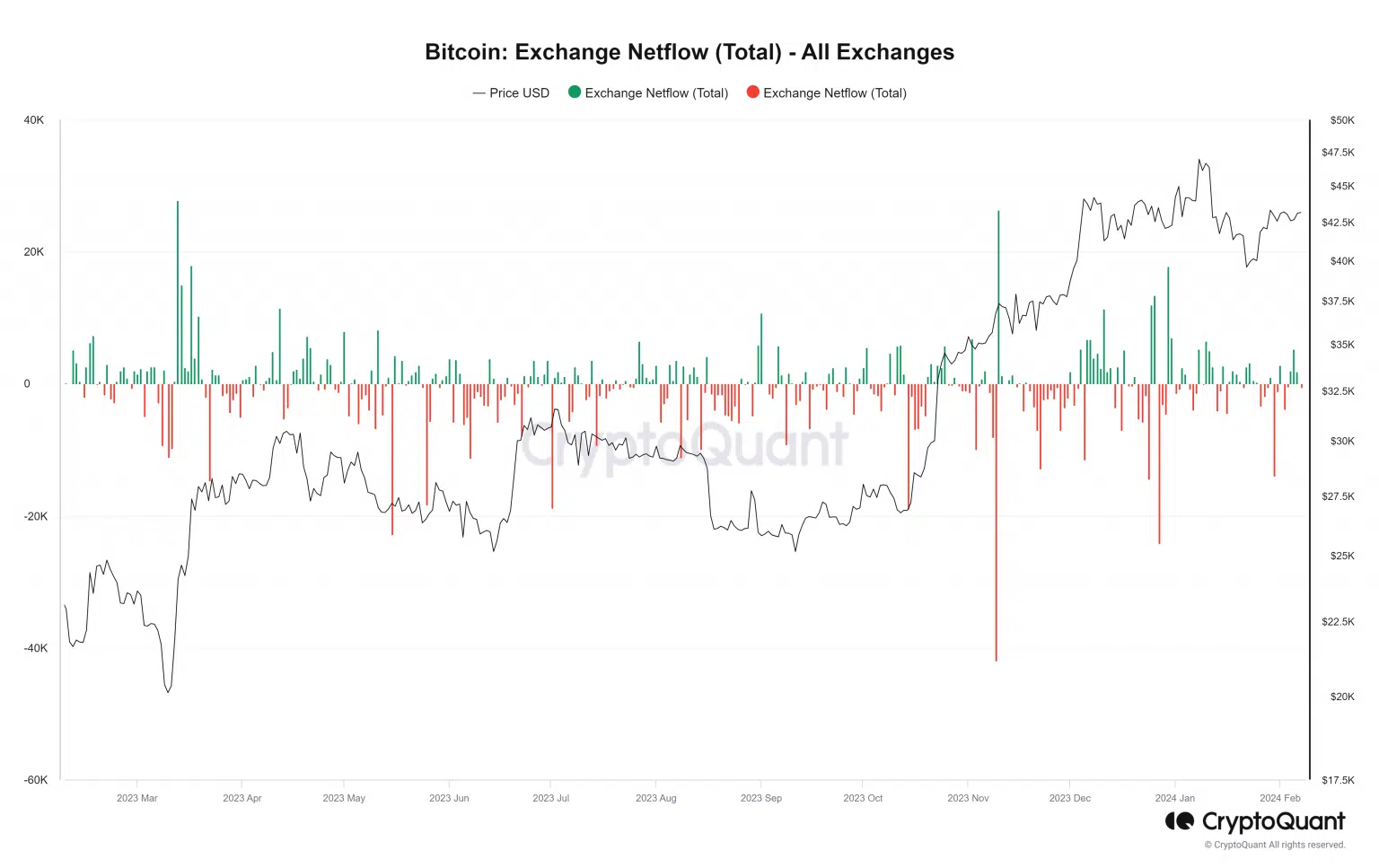

- Inflow to exchanges: Over 7,000 BTC were deposited into exchanges recently, potentially indicating some selling pressure.

- BTC price hovering around $43,000: Despite the mixed signals, Bitcoin is currently holding above the $43,000 mark, with its RSI neutral.

Price Predictions Remain Uncertain:

While the halving is expected to be bullish in the long term, predicting its exact impact on price is difficult. The current accumulation trends and whale behavior suggest potential for upward movement, but sell-offs and broader market conditions could create volatility.

Overall, the Bitcoin market is in a wait-and-see mode before the halving. While there are conflicting signals, the event itself is likely to be a catalyst for significant price movements in the future.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates