Bitcoin mining firm MARA Holdings has posted strong results for Q4 2024 while revealing its plans to capitalize on the “second wave” of AI technology.

MARA, in its Q4 statement released on February 26, outlined its ambition to become the base layer infrastructure for AI and high-performance computing applications, drawing parallels to Cisco’s role during the internet boom.

MARA Holdings CEO stated, “Whether for Bitcoin mining or AI inference, we believe our technologies will enable others to build while we provide the picks and shovels to deploy new systems and services, such as energy management, load balancing, and infrastructure.”

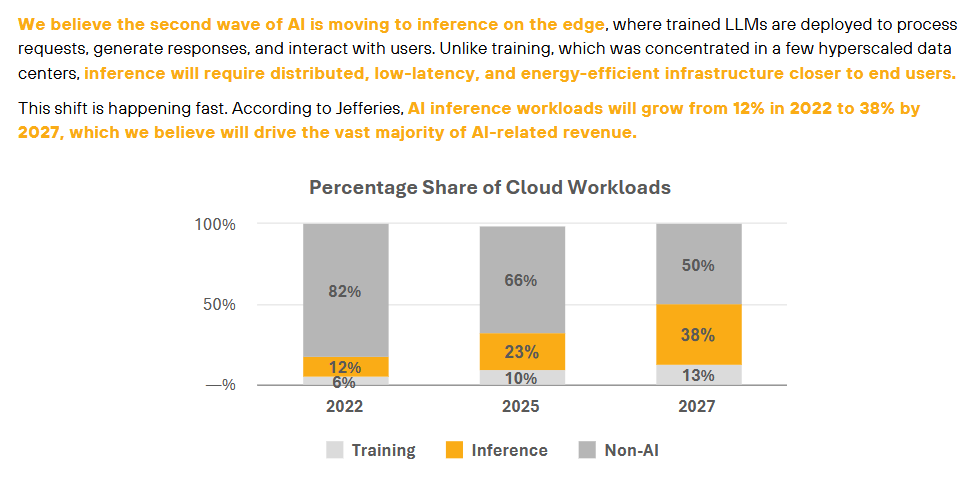

The company also mentioned that it took a “strategic pause” to assess the first wave of AI, where many of its Bitcoin mining competitors rushed into the field of leveraging data centers to train large language models. Instead, MARA believes that the biggest opportunities often emerge in the second wave, where those who observe and strategically position themselves will benefit most.

MARA’s Focus: AI Inference

MARA is focusing on the second wave of AI, which it believes will revolve around AI inference rather than training. Inference involves the AI model making its own decisions and conclusions without human intervention, after being trained. The company aims to support this with its infrastructure, which it believes will resemble traditional cloud computing.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

MARA’s Q4 Financial Results

MARA reported $214.4 million in revenue for Q4, exceeding the consensus estimate of $183.9 million by 16.5%. The company also added 18,146 Bitcoin to its holdings.

Net income reached $528.3 million, marking a 248% year-over-year increase, while adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) rose by 207% to $794.4 million.

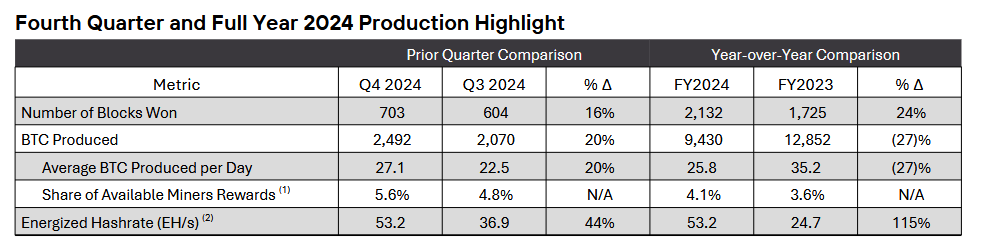

The company increased the number of Bitcoin blocks won by 25% year-over-year, mining a total of 2,492 Bitcoin. All of these Bitcoins were retained under MARA’s new treasury policy, which aims to “retain all BTC” for the company. Additionally, MARA purchased another 14,574 BTC using cash and proceeds from its zero-coupon convertible senior note offerings.

By the end of 2024, MARA held a total of 44,893 Bitcoin, solidifying its position as the second-largest corporate Bitcoin holder behind BitBo’s Strategy as per BitcoinTreasuries.NET data.

Increase in Energy Capacity and Mining Facilities

MARA also increased its hashrate to 53.2 exahashes per second (EH/s), representing a 115% increase from Q4 2023. A significant portion of this increase came from securing 300% more energy capacity in 2024 while expanding to seven Bitcoin mining facilities.

Additionally, MARA launched 25-megawatt micro data centers in Texas and North Dakota, reducing the company’s reliance on grid power.

The strong Q4 performance saw MARA (MARA) shares rise 5.9% in after-hours trading to $13.18, though they later pulled back to $12.89. MARA shares closed the February 26 trading day at $12.45 according to Google Finance data.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.