In the last three trading days, there has been a big drop in Bitcoin mining shares, which points to a value loss of up to 27% despite Bitcoin rising almost to $64,000. This decrease, according to some analysts, stems from misguided concerns about the upcoming halving event and presents a new opportunity to buy cheap mining shares.

Since February 27, the top two Bitcoin miners, Marathon Digital Holdings (MARA) and Riot Platforms (RIOT) have fallen by 18.5% and 21.9% respectively. Other mining companies like CleanSpark (CLSK) and TeraWulf (WULF) also experienced large drops.

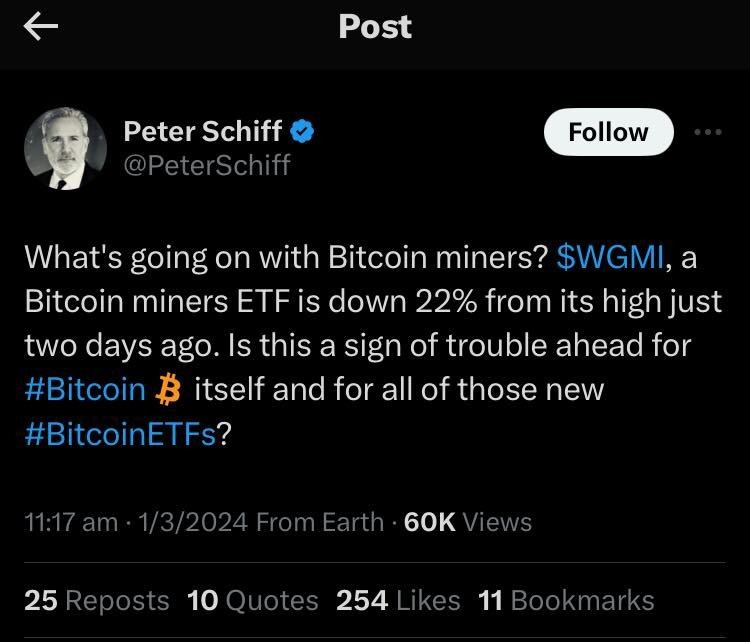

On the other hand, the value of Bitcoin recently rose from $51,000 to almost $63,700, but eventually fell back to $61,350. In the meantime, gold supporter and crypto opponent Peter Schiff is one of those who noticed this decline in Bitcoin mining shares and thinks this situation could be a sign of troubles ahead for Bitcoin.

A crypto investor named “Chris” states that he quickly changed his stance on mining shares as Bitcoin approached the $65,000 level while investing in shares like CleanSpark.

The chief analyst of Blockware Solutions, Mitchell Askew, stated that the most “logical” explanation for this decline is investors’ reluctance to invest capital due to the rapidly approaching halving event.

The halving event will see Bitcoin miners’ rewards drop from 6.25 BTC, or $586,800 at current prices, to 3.125 BTC, or $293,400 at current prices.

Askew pointed out that there have been two major drops in Bitcoin and Bitcoin mining shares in the last 12 months, and both instances were great opportunities to buy mining shares at a discounted price.

The founder and chief mining strategist of Hashlabs Mining, Jaran Mellerud, thinks that the 3-4 months following the Bitcoin halving could be a critical period for public miners in the United States, and that some high-cost miners may relocate abroad to maintain profitability.

Askew highlighted it’s “foolish” to think that the halving will leave them facing the risk of being unprofitable.

“They have the lowest energy costs and have acquired the latest generation hardware in preparation for the decrease in block rewards,” said Askew in his statement.

You can present your own thoughts as comments about the topic. Moreover, you can follow us on Telegram and YouTube channels for this kind of news.