Data on Bitcoin options expiration suggests that crypto market volatility is decreasing in the future. This suggests that the crypto market may enter a more stable period amid macro headwinds that have been strongly disconnected from U.S. tech stocks.

This week, Bitcoin prices faced strong resistance at $61,300 before falling to below $57,000 on Thursday before recovering somewhat. All eyes now turn to Friday’s Bitcoin options expiration, which suggests a tight battle between bulls and bears.

Bitcoin Options Expiration and Decreasing Market Volatility

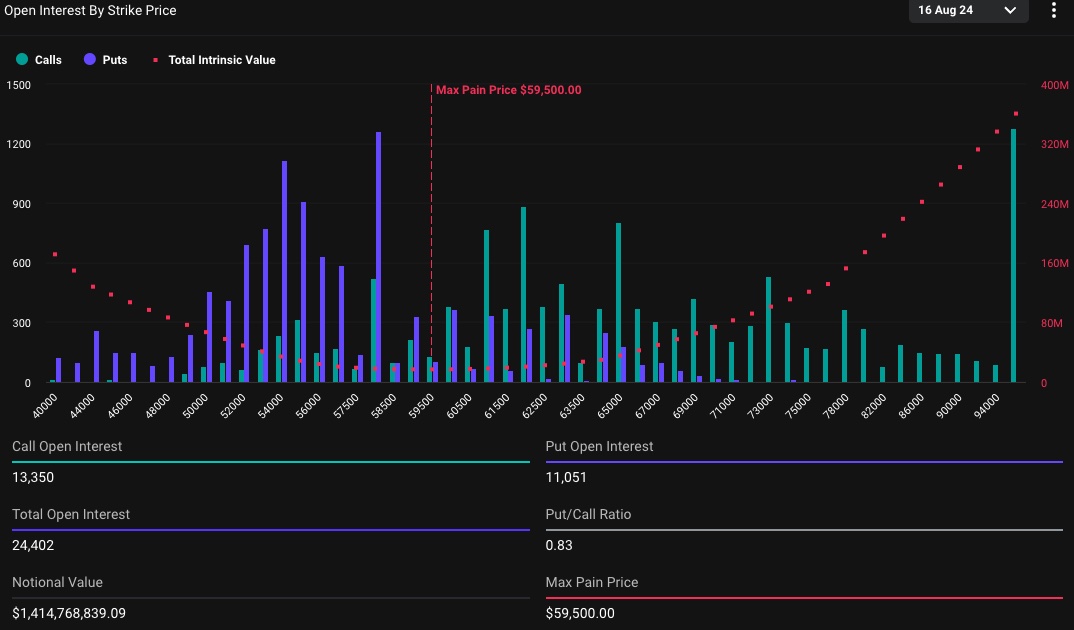

A total of 24,000 Bitcoin options will expire on Friday, August 16. These options have a put-call ratio of 0.83 and a notional value of $41.4 billion. This put-call ratio shows that an intense struggle is ongoing between the bulls and bears. At press time, the Bitcoin price is trading at $58,077, down 5%, and technical indicators suggest that the BTC price could fall to $54,000.

The current options expiration represents only 10% of the open positions in the market, with positions in August, September, and December accounting for just over 20% each. Therefore, the expiration distribution of options remains relatively balanced and shows strong resistance. The options market indicates that the market may enter a more stable period, indicating decreasing volatility in the crypto market in the future.

Might interest you: Bitcoin Sell Pressure Could Test $56K Support as Options Expiry Nears

This indicates that Bitcoin and the cryptocurrency markets in general may enter a more balanced and predictable period compared to previous periods of high volatility. Investors and market observers will be closely monitoring this process and will take this data into account to predict future price movements.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.