Bitcoin price analysis, we will analyze past price movements through charts and technical indicators. We will determine support and resistance levels and guide investors in their buying and selling decisions.

You might like: CEO: Can Bitcoin Reach $1 Million?

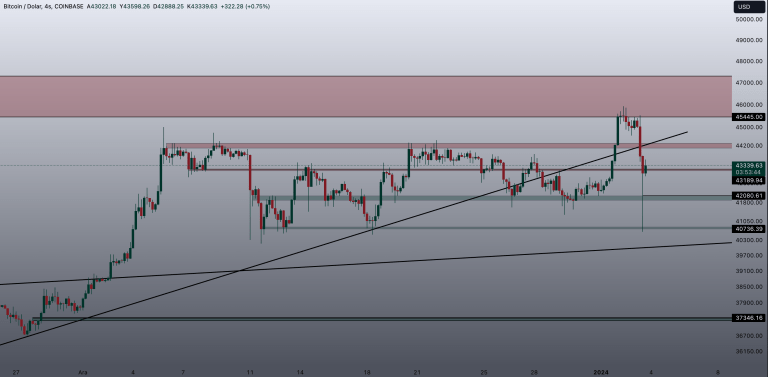

According to a news released today, Matrixport’s Bitcoin spot ETF will be rejected and will not be approved until the second quarter of 2024. After that, Bitcoin saw a sharp sell-off from the $45,518 level, causing panic. Although most analysts say that the approval of the Bitcoin spot ETF by January 10 is a political reason, Matrixport has brought a different perspective to these news.

After the Matrixport news, Bitcoin saw a sharp drop to the $40,600 level.

In BTC, after the upward breakout did not come above the $45,445 level, it could not enter this area. Afterwards, we realized that the sellers were strong in this area by leaving wicks. After that, with the effect of the news, it first broke the $44,300 level in a voluminous way and continued to decline. When panic selling was added to the effect of the news, the $42,000 was also broken and Bitcoin fell to the $40,750 region.

After stopping below $42,000 for 5 minutes, buyers became more aggressive with the involvement of diamond hands and carried the price back above $42,000. We understood the importance of the $42,000 support in this decline. In fact, we can say that we are in a risky area in the market when we lose $42,000. If we start closing candles below $40,750, we can conclude that the declines may continue for a while if there are not enough buyers.

So, whether the Bitcoin ETF is approved or rejected, manipulations will continue in the market until there is a clear news. Keeping cash in such environments, whether the market is rising or falling, will always be an important factor that can turn your portfolio from loss to positive.