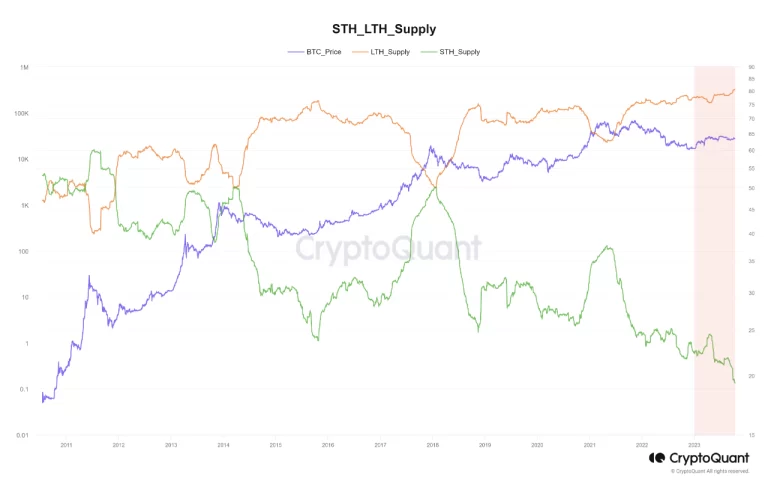

Bitcoin Reaches Historic Low in Short-Term Supply! One of the best ways to track the activity and status of Bitcoin owners is to divide the supply of Bitcoin into two categories. They are Short-term and long-term. This metric allows us to examine the transfer of wealth among Bitcoin owners in each market cycle.

With this concept in mind, we have observed a new historic decline in short-term Bitcoin ownership for the 2023 price cycle, particularly due to the weak performance in the second and third quarters of this year. As the supply among short-term owners decreases, you might think that long-term owners will face less selling pressure. However, this is not the case.

Bitcoin’s price cycles

We are looking at all of Bitcoin’s price cycles. Thus, we see an increase in supply among short-term owners in all long-term bull cycles. Simply put, the influx of new capital and increasing price performance encourages short-term owners to adopt longer-term behavior and hold their Bitcoins for longer periods. Surprisingly, this change in behavior is significantly lacking in the current cycle.

You might be interested: Stars Arena Open for Use!

Short term supply of Bitcoin

Over the past few months, short-term ownership decreased following Bitcoin’s weak price performance and new capital, usually represented by new investors, did not show strong confidence in the price trend of Bitcoin.

In conclusion, the 2023 market cycle did not provide significant wealth transfer to short-term owners or new investors. Regaining confidence and level of hope among short-term owners becomes critical for sustainable long-term price increase. This historical drop in short-term Bitcoin ownership serves as a unique indicator of the current market sentiment and leads us to review both short-term and long-term investor strategies and expectations in this constantly changing crypto landscape.

In the comment section, you can freely share your comments about the topic. Additionally, don’ t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.