The U.S. decision to accept Bitcoin as a reserve currency has led to significant fluctuations in the cryptocurrency markets. Following the announcement, Bitcoin and Ethereum, among other cryptocurrencies, experienced sharp declines. So, how have the markets reacted to this development? Here’s the latest on Bitcoin and Ethereum, along with the critical support-resistance levels to keep an eye on.

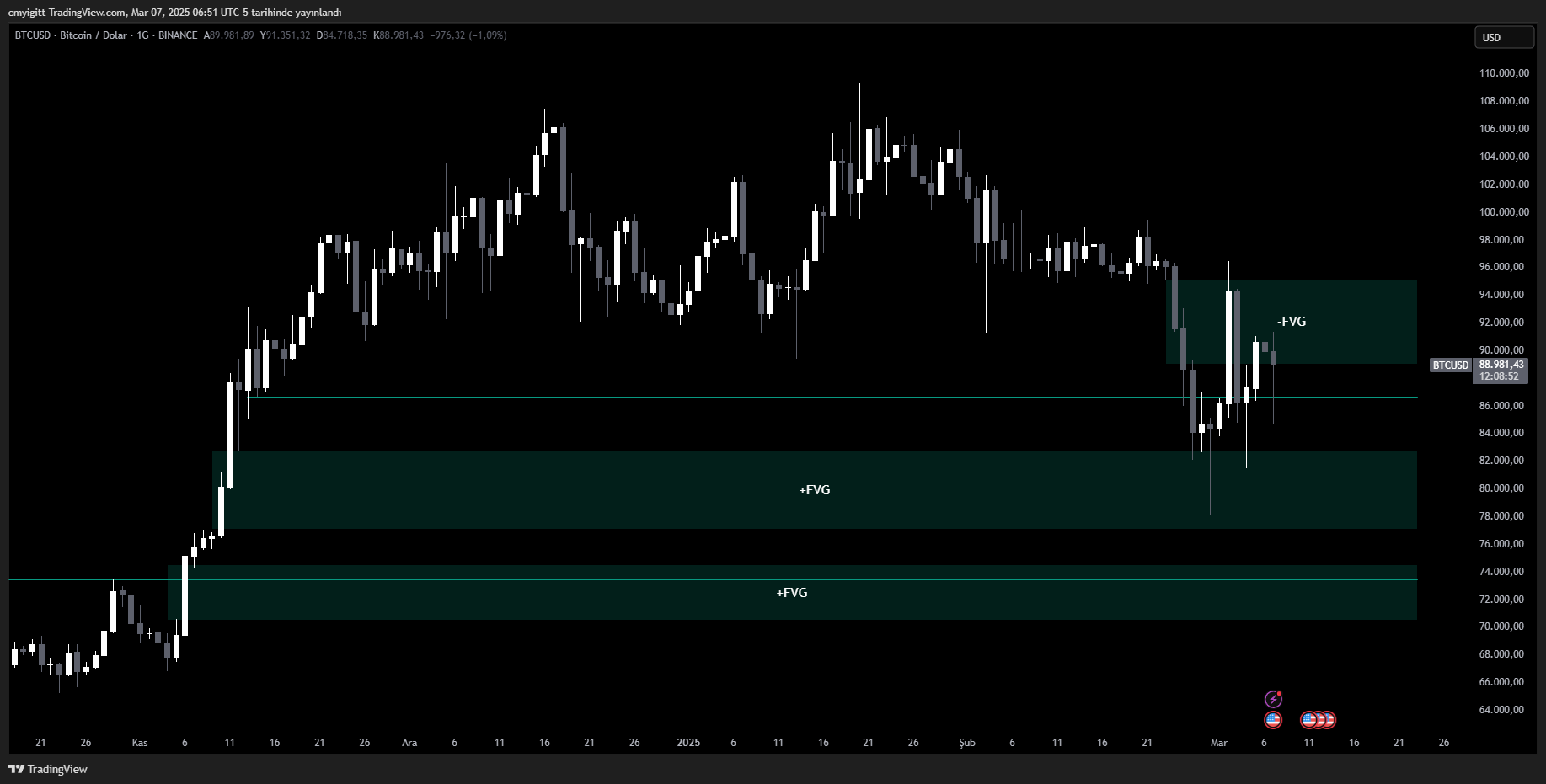

Bitcoin (BTC) Current Situation

Bitcoin (BTC), after the U.S. reserve currency decision, saw a 2.54% drop, falling to $89,068. During the day, it dropped as low as $86,641, but received a strong rebound from this level, rising back towards the resistance zone. Currently, Bitcoin is trading around $89,000, and if it loses the $86,641 support, the next critical support level would be at $82,785, within the upward-facing FVG (Fair Value Gap) zone.

For Bitcoin investors, $86,641 is a critical support level. If this level is breached, $82,785 could serve as an important zone for BTC to recover.

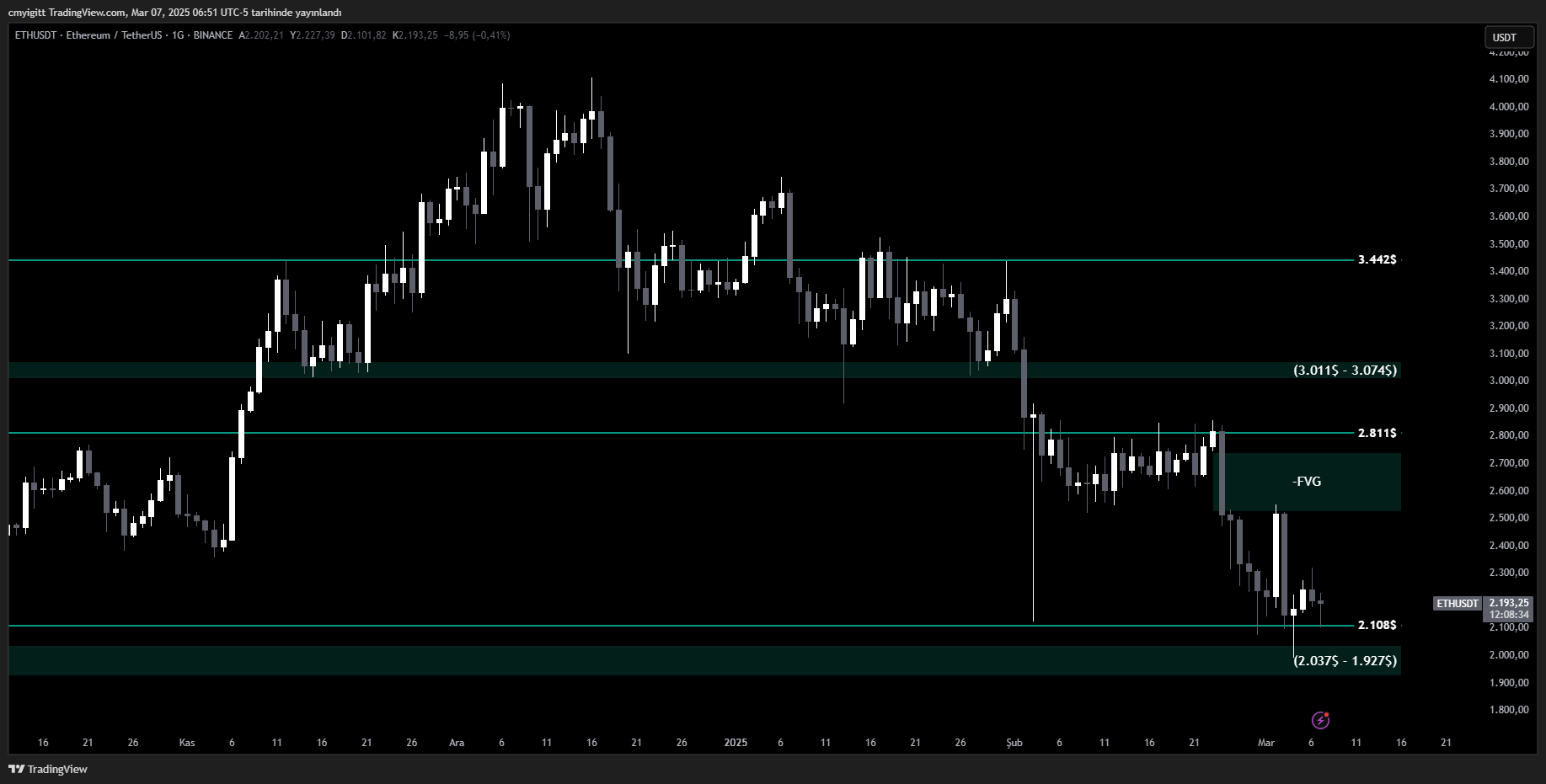

Ethereum (ETH) Current Situation

On the other hand, the selling pressure on Ethereum (ETH) was more pronounced. Over the past 24 hours, ETH lost 4.29%, dropping to $2,194. Following yesterday’s drop, it found strong support at $2,108, bouncing back quickly. However, if this support is broken, the next significant support level will be in the range of $2,037-$1,927.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

For Ethereum, the nearest resistance in the upward movement is the downward-facing FVG zone. ETH investors should monitor whether the $2,108 support can hold.

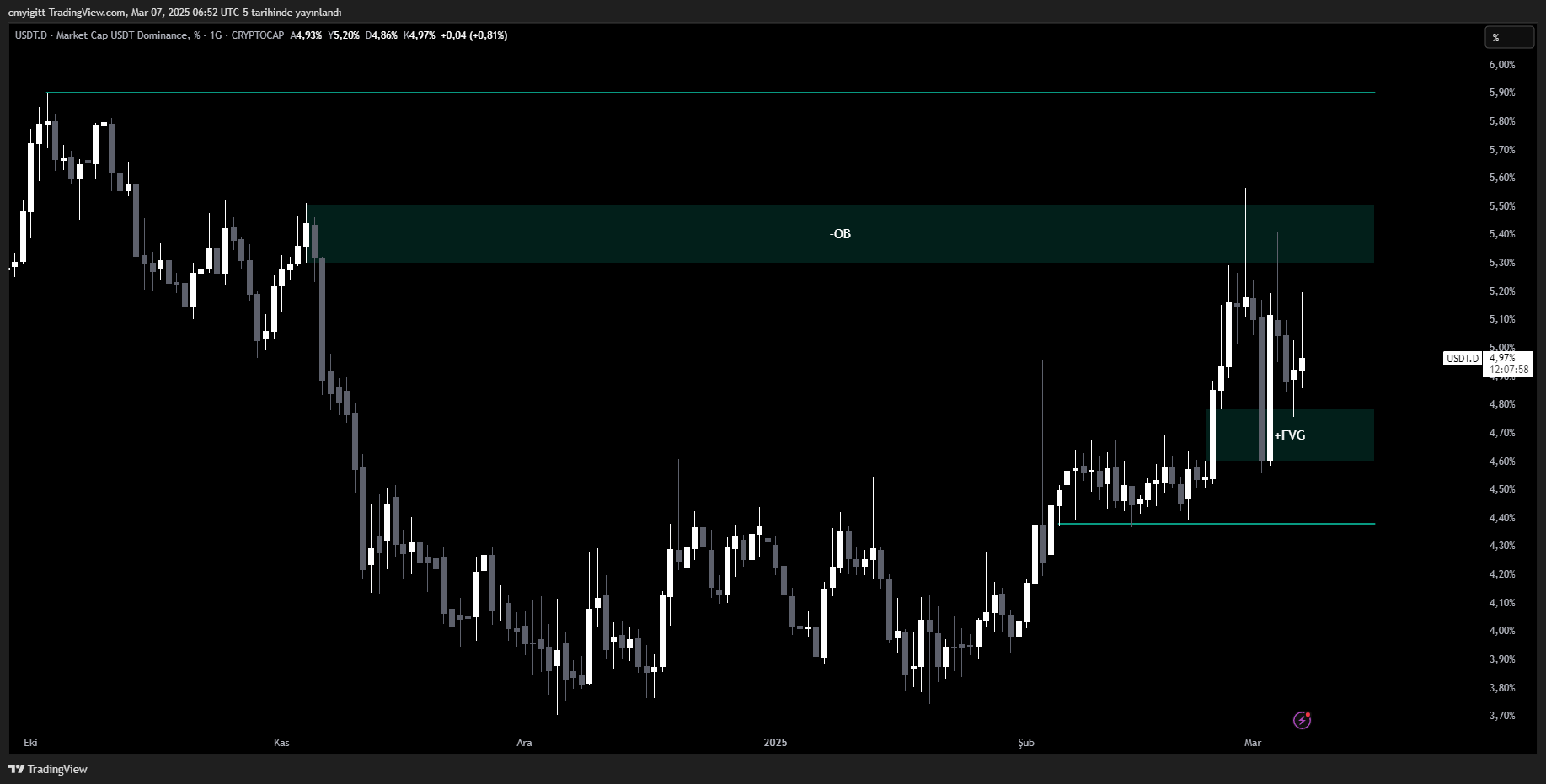

Tether Dominance (USDT.D) and Market Sentiment

Another key indicator of reduced risk appetite in the crypto market is Tether Dominance (USDT.D). Over the last 24 hours, USDT.D increased by 0.73%, reaching 4.96%. During yesterday’s downturn, USDT.D peaked at 5.20%, but has slightly retraced and found support within the upward-facing FVG zone. The next resistance for USDT.D lies in the downward-facing order block zone.

The rise of USDT.D signals a decrease in market confidence towards cryptocurrencies, with investors possibly seeking safer assets. A further decline in USDT.D might increase the appetite for risk in the crypto space.

The U.S. decision to accept Bitcoin as a reserve currency has triggered volatility in the cryptocurrency markets. The prices of Bitcoin and Ethereum are currently fluctuating at critical support and resistance levels. These levels will likely dictate the market’s direction in the coming days, making it crucial for investors to monitor them closely.

The developments in the cryptocurrency market continue to draw global attention, and the direction of prices will depend on the sentiment of market participants. This volatility in Bitcoin and Ethereum presents new opportunities for crypto investors, while also carrying significant risks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.