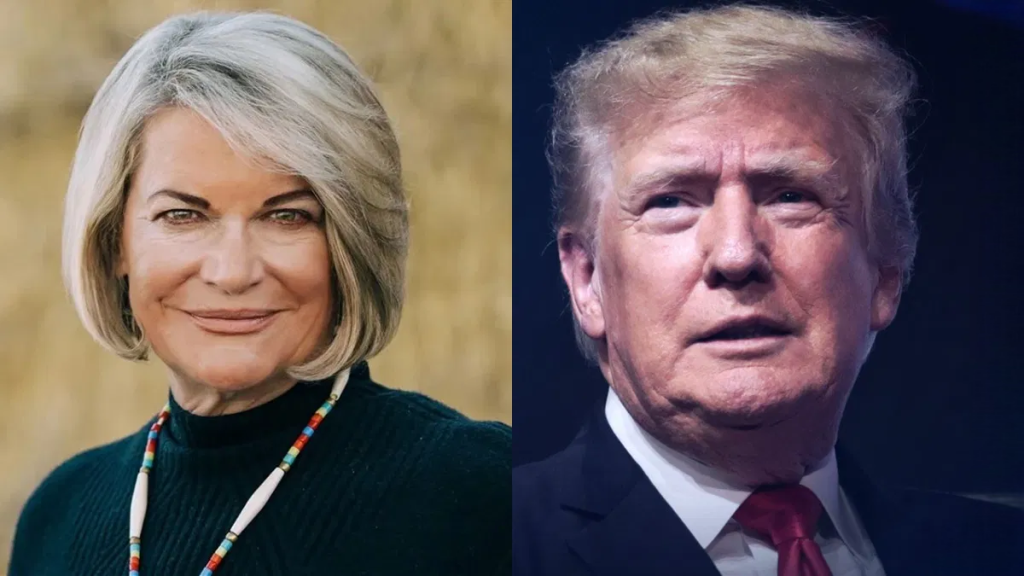

Former President Donald Trump and Wyoming Republican Sen. Cynthia Lummis have suggested strategies wherein the U.S. government owns bitcoin. While detractors expressed worries over bitcoin’s growing influence, advocates claimed the asset might be considered a buffer against swings as markets slid on Monday.

Lummis’s Proposal

Last week, Lummis sent a draft law to the U.S. Treasury ordering one million bitcoin purchases spread over five years. Unless the tokens are sold to help lower the debt, Lummis stated.

Should he be elected president later this year, GOP presidential nominee Donald Trump has also declared he would establish a national bitcoin reserve.

Last month, independent presidential candidate Robert F. Kennedy Jr. made such pledges at Bitcoin 2024, stating he would execute an executive order instructing the U.S. Treasury to purchase 550 bitcoin every day until the country has a reserve of four million bitcoin.

Markets collapsed roughly one week later, carrying bitcoin with them. The value of the cryptocurrency dropped by approximately 16%. On Monday, ether plunged even more sharply—by almost 23%.

Advocates’ Perspective

“Short-term volatility is common with any store of value, including gold or oil, which the United States holds significant reserves in,” Lummis said in an emailed statement, adding that a bitcoin reserve has “fundamental benefits” that remain robust.

“This is why my legislation takes a long-term view that requires the U.S. Treasury to gradually acquire Bitcoin over a five-year period and hang onto it for at least 20 years,” she stated.

This Might Interest You:

Cody Carbone, Chief Policy Officer of the Digital Chamber, said Lummis’s suggested bitcoin reserve is designed to better manage market swings than more conventional assets, including stocks.

“Bitcoin has shown it can bounce back rapidly from market declines, proving to be a strong and reliable asset,” Carbone said in a note. “Like gold, Bitcoin is starting to seem like a safer investment as more people and businesses start using it.” The idea hopes to maximize the long-term stability and distributed character of Bitcoin by including it in national reserves, therefore strengthening financial security for the economy and acting as a buffer against market fluctuations.

Opposing Views

Some have objected to the U.S. Treasury owning bitcoin, though.

According to Dennis Kelleher, CEO of Better Markets, oil and gold have a “strategic purpose.” Kelleher, who has also criticized cryptocurrencies in the past, claimed a bitcoin reserve scheme would artificially raise the price of the currency.

“After 15 years of development, a new financial product with no use case and no justified social use has no strategic value. Gaming and speculating are the only non-illegal uses for cryptocurrencies,” Kelleher said.

According to Moe Vela, a former senior assistant to President Joe Biden, the declining crypto market on Monday confirms its legitimacy and indicates that crypto has attained some equivalency with the conventional market. He also serves as a senior advisor to Unicoin, a cryptocurrency.

“As for the market fluctuation and the Trump and Lummis suggestions of Treasury money being held in bitcoin reserves, it furthers my concerns about the volatility of an asset less crypto like bitcoin, and it’s a stark reminder that the mystery of who is behind bitcoin should make it off limits to Treasury funds whatever,” Vela said.