Morgan Stanley’s head of digital assets, Andrew Peel, has warned that Bitcoin could pose a threat to the U.S. dollar. He warned that the rise of central bank digital currencies (CBDCs) could also challenge the dollar’s dominance.

You might like: Solana Mobile to Launch Second Crypto Phone!

The “innovative transformation” in the perception and use of digital assets, especially Bitcoin, is leading to warnings from Wall Street investment bank Morgan Stanley that CBDCs could challenge the U.S. dollar’s global reserve currency status.

In a research note published on January 1, Andrew Peel, head of digital assets at Morgan Stanley, noted that the dollar still accounts for about 60% of global foreign exchange reserves. However, Peel predicted that the “transformation in how digital assets are perceived and used around the world” could challenge the dollar’s dominance.

Weekly inflows into new products reaching $1.18 billion (Bitcoin)

Peel noted that this transformation has accelerated with the approval of various spot Bitcoin exchange-traded funds in the United States by the U.S. Securities and Exchange Commission, with weekly inflows into new products reaching $1.18 billion.

Peel also sees Bitcoin’s “extraordinary” global adoption over the past 15 years as a sign of continued growth. He noted that there are currently 106 million people around the world who own cryptocurrencies and that there are Bitcoin ATMs in over 80 countries.

On the other hand, CBDCs created by other countries also have the potential to challenge the dollar’s dominance. This could enable faster cross-border payments without the need for a common currency.

“[CBDCs] have the potential to create a unified standard for cross-border payments; this could reduce reliance on traditional intermediaries such as SWIFT and the use of dominant currencies such as the dollar.

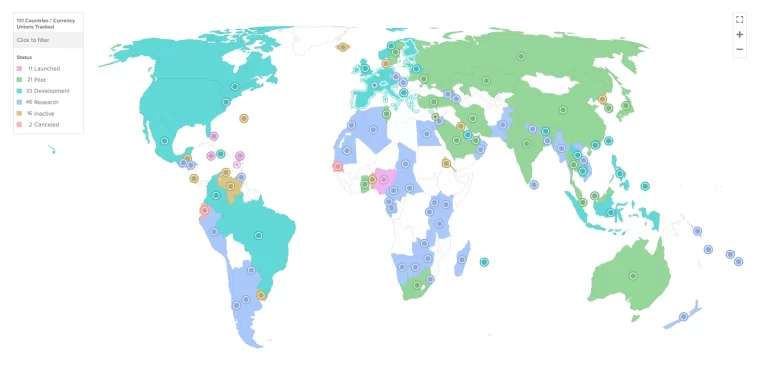

According to data from the Atlantic Council CBDC Tracker, more than 98% of global gross domestic product is represented by 130 countries that are researching or developing central bank digital currencies (CBDCs). This represents a significant increase compared to just a few years ago. CBDCs have the potential to create significant changes in the financial systems and monetary policies of many countries around the world.

Peel said, “CBDCs also have the potential to revolutionize financial services, such as automating payments with smart contracts and making programmable money a practical reality.”

While Bitcoin and CBDCs threaten the dollar’s dominance, Peel believes that stablecoins could make a greater contribution to the global financial system. He called highly fiat-backed stablecoins the “revolutionary application” of cryptocurrency.

“With their growing importance, dollar-backed stablecoins will have a profound impact on the financial sector and could potentially reshape the way money moves across borders.”