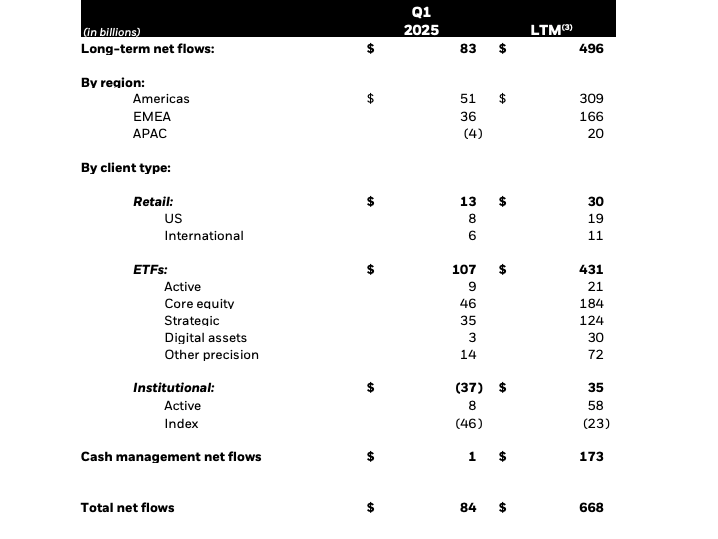

BlackRock, the world’s largest asset manager with $11.6 trillion in assets under management, reported $84 billion in total net inflows for Q1 2025, marking a 3% annualized growth in assets under management.

The firm’s strong performance was driven by a record-breaking first quarter for iShares exchange-traded funds (ETFs), alongside sustained growth in private markets and net inflows, according to BlackRock’s Q1 earnings released on April 11.

Of the $107 billion in net inflows to iShares ETFs, $3 billion, or 2.8% of the total ETF inflows, was allocated to digital asset products during Q1, BlackRock reported.

Alternative investments also had a significant impact, with private market inflows totaling $9.3 billion.

Digital Assets Still a Small Segment for BlackRock

As of March 31, 2025, digital assets accounted for $34 million in base fees, making up less than 1% of BlackRock’s long-term revenue.

By the end of Q1, BlackRock’s total digital assets under management reached $50.3 billion, representing approximately 0.5% of the firm’s $11.6 trillion in total assets under management.

BlackRock’s financial results indicate that digital assets still account for a small share of the company’s business, despite the $3 billion in inflows, which is significant in light of the widespread liquidations in the Bitcoin ETF market earlier this year. These figures suggest that investor interest in crypto-backed ETFs remains strong.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.