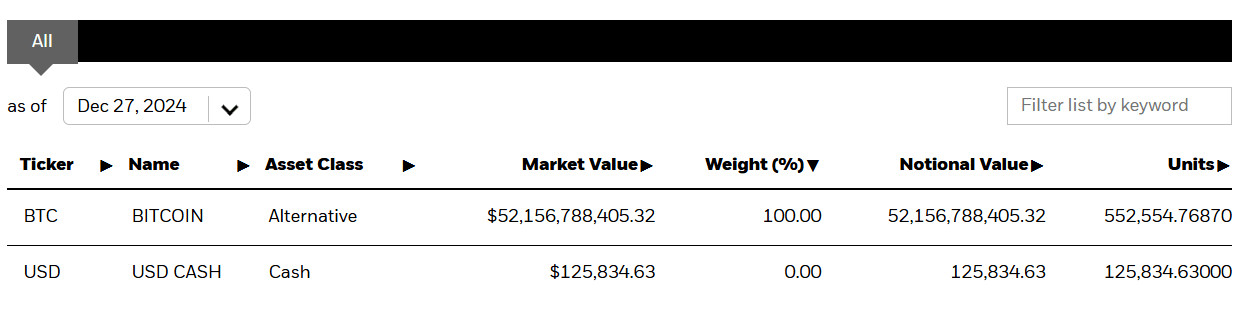

The iShares Bitcoin Trust (IBIT), BlackRock’s spot Bitcoin exchange-traded fund (ETF), has dominated 2024 and made its mark on financial history. Launched earlier this year, this groundbreaking fund amassed over $50 billion in assets within just 11 months, becoming a global phenomenon. This record-breaking growth symbolizes the strengthening bridge between traditional finance and the crypto world.

2024’s Star: iShares Bitcoin Trust

BlackRock’s iShares unit has launched over 1,400 ETFs to date, but none have experienced the meteoric rise of the iShares Bitcoin Trust. Within its debut year, IBIT reached a staggering $50 billion in assets under management, earning the title of the biggest ETF launch in history.

ETF industry authority Nate Geraci described IBIT’s success as “unprecedented in financial history.” According to Geraci, this achievement not only highlights Bitcoin’s growing popularity but also cements BlackRock’s influence in the investment world.

A Milestone in Financial History

Todd Sohn, Managing Director of ETF and Technical Strategy at Strategas Securities, emphasized IBIT’s remarkable growth. Sohn noted that IBIT’s total assets in just 11 months are equivalent to the combined assets of over 50 European ETFs, many of which have been on the market for over two decades. This highlights the increasing adoption of digital assets by both retail and institutional investors.

BlackRock and the Future of Crypto

BlackRock has once again proven itself to be more than a fund provider—it is a pioneer of financial innovation. IBIT’s success solidifies digital assets’ place in the traditional financial world and has prompted more investors to consider Bitcoin. This milestone could also encourage other major financial institutions to launch their own spot Bitcoin ETFs.

This landmark development in the crypto world signals the dawn of a new era in investing. IBIT’s success has heightened the appeal of crypto assets for both retail and institutional investors. In the future, Bitcoin ETFs could become a standard component of financial markets.

BlackRock’s spot Bitcoin ETF emerged as the financial star of 2024, achieving massive success just 11 months after its launch. This victory not only legitimizes crypto assets but also underscores their potential for future growth.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.