Bitcoin developer Blockstream is preparing to launch Bitcoin collateralized loan funds, receiving a multi-billion dollar investment The company’s new funds will allow institutional investors to borrow and lend on Bitcoin collateral

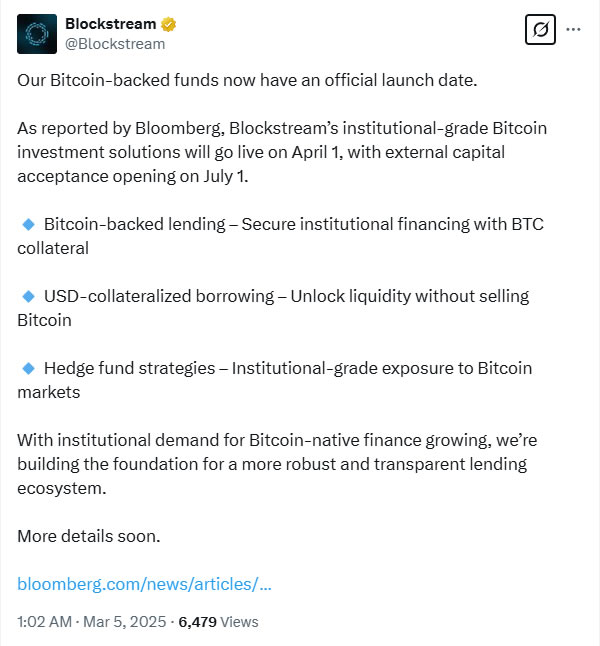

Blockstream announced that it will launch Bitcoin investment solutions for institutional investors on April 1, and will start accepting external investments from July 1. The company said its investment funds will offer Bitcoin collateralized loans, USD collateralized borrowing and hedge fund strategies

Three New Funds Coming

Blockstream has already announced two funds, Blockstream Income Fund and Blockstream Alpha Fund Three more funds are expected to be launched under the new investment plan

- Income Fund: focusing on loans between 100 thousand and 5 million dollars

- Alpha Fund: offers investors a growth-oriented portfolio with revenue models based on infrastructure such as the Lightning Network

In 2018, the company launched the Liquid Network sidechain to enable faster Bitcoin transactions In October, it provided 210 million dollars of financing through convertible bonds .

Bitcoin Collateralized Corporate Loan Term

Blockstream’s new investment products are an important step in showing how Bitcoin is becoming more accepted in the mainstream financial system The move has the potential to rival crypto-focused funds offered by major investment firms such as Grayscale, Pantera, Galaxy Digital and Crypto.com

Institutional investors will be able to gain liquidity without selling Bitcoin, while also developing strategies for institutional exposure to Bitcoin markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.