Bitcoin continues to hover around the $67,000 level, and a new market assessment from 10x Research highlights a concerning development beneath the surface: a sharp contraction in trading volumes across the crypto sector. According to the firm’s latest analysis, liquidity is gradually thinning, raising questions about the strength and sustainability of the current market structure.

Weekly Trading Volume Drops by 50%

Data compiled by 10x Research shows that average weekly crypto trading volume has fallen by approximately 50%, declining to around $100 billion. Such a significant contraction signals a notable slowdown in market participation and speculative activity.

The weakness is not limited to smaller altcoins. Bitcoin and Ether, the two largest digital assets by market capitalization, are also experiencing substantial volume declines. Current weekly trading activity in Bitcoin sits roughly 47% below its historical average, while Ether’s volume is approximately 58% below its norm. This broad-based reduction suggests that the market’s core liquidity engines are losing momentum.

“Liquidity Is Gradually Leaving the Market”

Analysts at 10x Research interpret the sharp drop in volume as an indication that the recent recovery attempt may be losing steam. In their view, capital is slowly rotating out of the crypto market, reducing the depth needed to sustain strong price advances.

Low-volume environments tend to amplify fragility. Without solid participation, upward price movements can lack conviction and are more vulnerable to abrupt reversals. As a result, the current backdrop calls for increased caution, particularly for short-term traders relying on breakout scenarios.

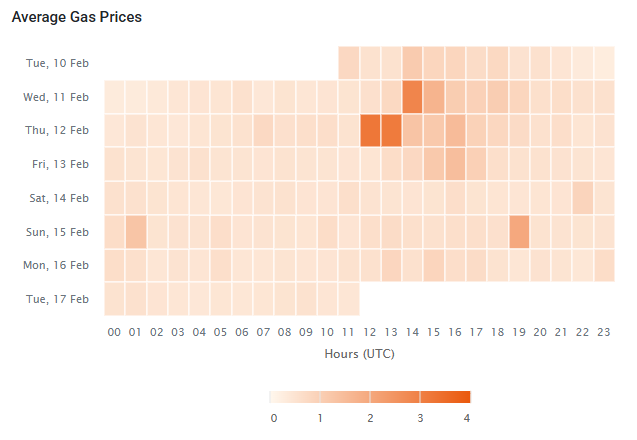

Additional Weakness in the Ethereum Network

The report also points to declining on-chain activity within the Ethereum ecosystem. Network fees have fallen to 0.04 gwei, placing them within the lowest 4% of historical readings. Such subdued fee levels typically reflect reduced demand for block space and weaker transactional intensity.

Why the Next Two Weeks Matter

10x Research further notes a growing disconnect between macroeconomic developments and crypto market performance. This divergence may increase uncertainty and complicate short-term forecasting.

The coming one to two weeks could prove decisive. If trading volumes fail to recover, the risk of a deeper correction may rise as liquidity conditions remain thin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.