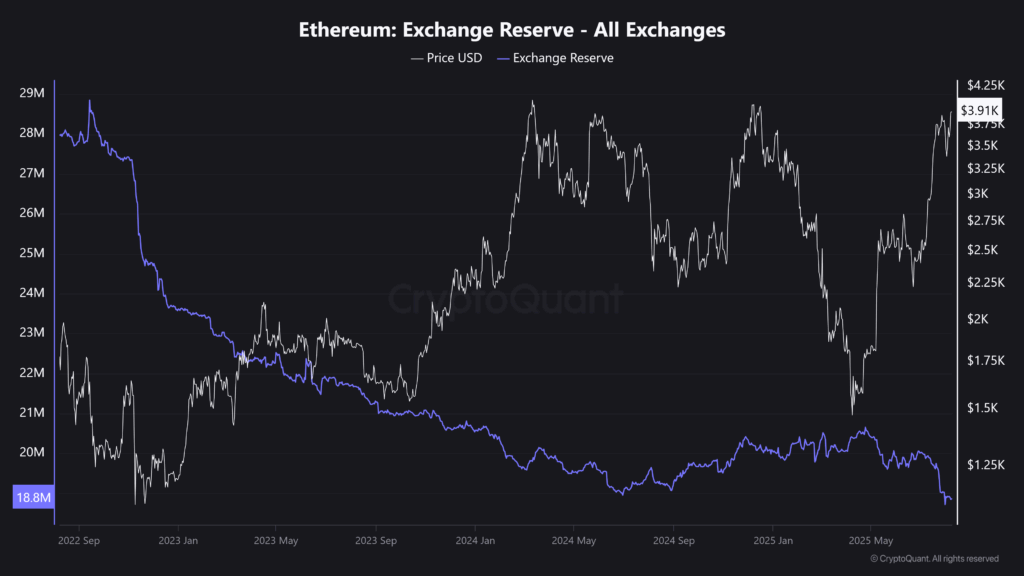

Significant changes are occurring recently in the exchange reserves of Ethereum, Chainlink, and Pi Network. Ethereum’s exchange reserves have fallen below 19 million ETH, reaching the lowest level in three years. ETH price approached $4,000 at the beginning of August. However, the price increase did not lead investors to send their ETH to exchanges. This indicates limited profit-taking. Meanwhile, institutional investors’ strategic ETH holdings surpassed $11.8 billion, helping Ethereum resist major selling pressure.

Ethereum Exchange Reserves and Institutional Demand

According to CryptoQuant data, strategic Ethereum reserves exceeded 2.7 million ETH and $10 billion at the end of July. In the first week of August, this figure rose to 3 million ETH. Institutional purchases kept ETH strong despite selling pressure. Investors interpreted the decrease in exchange reserves during ETH’s price rise as a sign of long-term confidence. This trend continues to support Ethereum’s market performance.

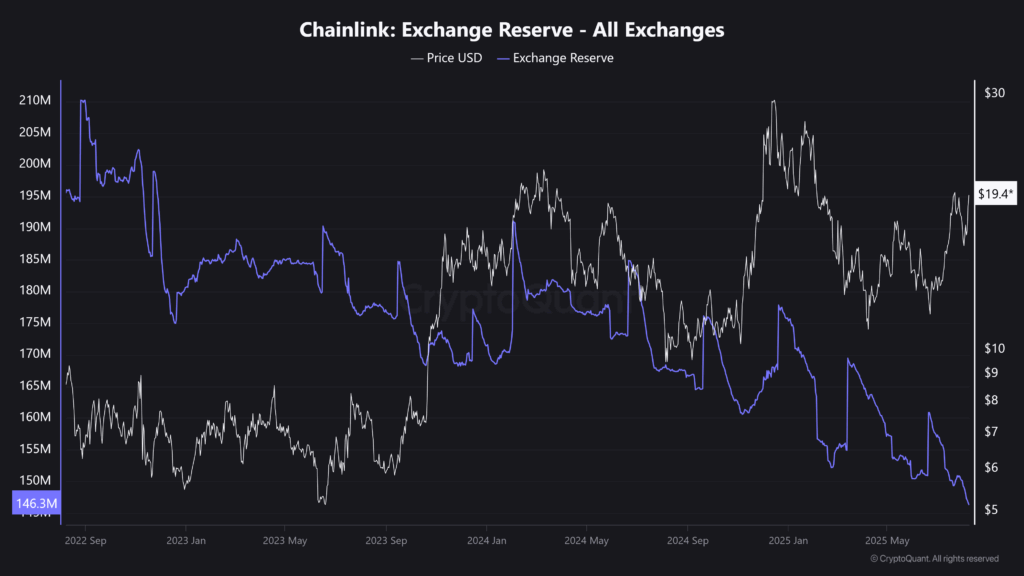

Chainlink (LINK) and Pi Network (PI) Exchange Reserves Activity

Chainlink’s exchange reserves have dropped by 16% since the beginning of the year to 146.2 million LINK. However, LINK price increased by 15%, rising from $15.5 to over $19. Santiment data revealed renewed accumulation of large LINK amounts in on-chain wallets. At the beginning of August, wallets holding between $100K and $1M LINK increased by 4.2%. Additionally, Chainlink Reserve, an application converting protocol revenues into LINK purchases, was launched in August, strengthening long-term accumulation trends.

Pi Network’s exchange reserves exceeded 405 million PI at the end of July but slightly dropped to 403 million PI in early August. This decline paralleled a 10% price drop to $0.366. Investors began to see these price levels as buying opportunities. This development, seen as a sign of renewed accumulation in Pi Network, warrants close monitoring of reserves. Meanwhile, while exchange supply decreases, prices show signs of recovery.

Conclusion

In the first week of August, Ethereum, Chainlink, and Pi Network experienced notable changes in exchange reserves. Institutional demand in Ethereum and long-term accumulation in Chainlink and Pi Network are dominant factors. These dynamics suggest the market is poised for a new upward momentum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.