Bitcoin recent price action has reignited concerns about whether the market is transitioning into a full-scale bear phase. After weeks of heightened volatility and accelerating losses, market structure signals suggest that the current correction may be more than a temporary pullback. Recent commentary from major liquidity providers supports the view that Bitcoin is now exhibiting classic bear market behavior.

Bitcoin Price Action Signals Bear Market Conditions

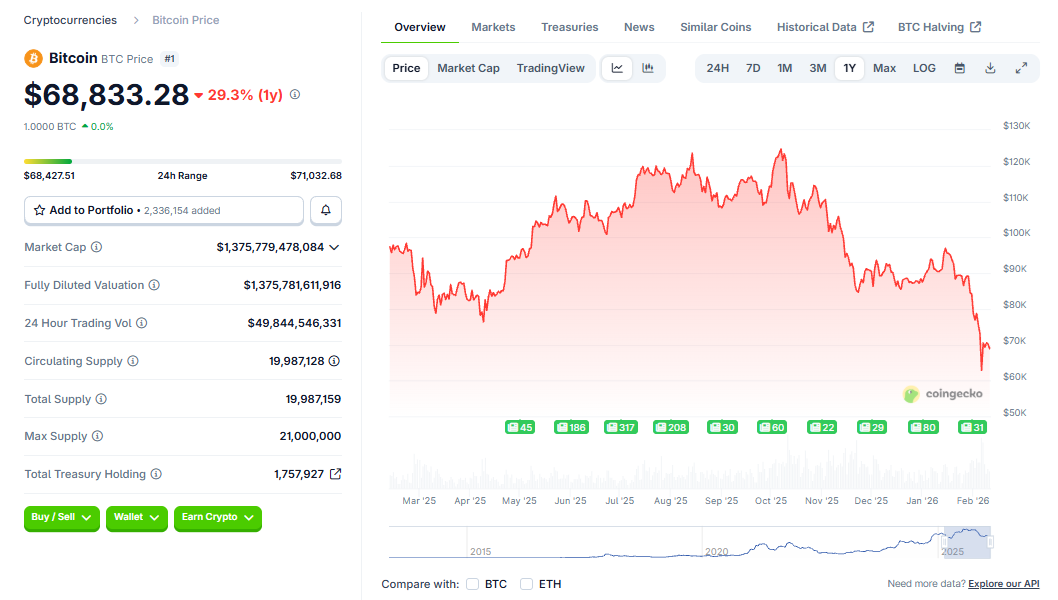

Over the past several weeks, Bitcoin has broken through multiple key technical levels. Most notably, the price slipped below $80,000 for the first time since April 2025 and quickly extended losses toward the $60,000 region. In just four months, Bitcoin has shed nearly 50% of its value, highlighting the intensity of the selling pressure.

One of the clearest signs of stress came from derivatives markets. Weekend liquidations exceeded $2.7 billion, indicating a large-scale unwind of overleveraged positions. Such liquidation cascades are commonly associated with bear market phases, where excessive risk-taking is rapidly flushed out of the system.

Three Catalysts Accelerating the Sell-Off on Bitcoin

According to market analysts, the downturn was not driven by a single event but rather a combination of macroeconomic and cross-market shocks.

The first factor was growing concern over the future direction of U.S. monetary policy. The possibility of Kevin Warsh being appointed as Federal Reserve Chair fueled expectations of a more hawkish stance, prompting investors to reduce exposure to risk-sensitive assets, including cryptocurrencies.

The second driver came from traditional equity markets, particularly the technology sector. Earnings disappointments among the so-called “Magnificent Seven” weighed heavily on sentiment. A sharp decline of roughly 10% in Microsoft shares served as a catalyst for broader risk aversion, spilling over into digital assets.

The third and most striking development occurred in commodities markets. Silver prices collapsed by approximately 40% in just three days, reinforcing a widespread “sell everything” mindset. This type of cross-asset capitulation tends to amplify downside pressure across all speculative markets, crypto included.

Persistent Selling Pressure From U.S. Markets

Additional data points suggest that selling pressure is not limited to derivatives or offshore venues. Spot market activity in the United States continues to show consistent distribution. Over-the-counter transaction flows indicate that U.S.-based participants have remained net sellers, reinforcing the idea that this move reflects deeper repositioning rather than short-term speculation.

What the Broader Picture Suggests

Taken together, Bitcoin’s rapid drawdown, aggressive leverage unwinding, and macro-driven risk-off environment point to a market undergoing structural stress. While short-term volatility remains elevated, the current phase appears driven by a convergence of monetary policy uncertainty, equity market weakness, and cross-asset liquidation dynamics. How long this pressure persists will depend largely on macro conditions and investor risk appetite in the months ahead.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.