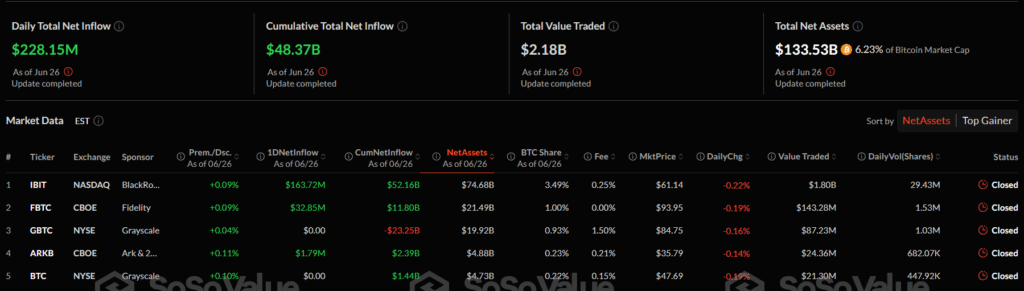

According to data released by SoSoValue on June 27, Spot Bitcoin ETFs saw a net inflow of $228 million on June 26. This figure highlights continued institutional interest in Bitcoin (BTC) and strong market confidence.

The biggest contribution of the day came from BlackRock’s IBIT (iShares Bitcoin Trust) fund. IBIT recorded the highest inflow with $164 million. Fidelity’s FBTC fund followed with $32.85 million in second place. Bitwise, VanEck, and Ark 21Shares also contributed to this upward trend.

- FBTC (Fidelity): $32.85M inflow – Total net inflow $11.80B

ARKB (Ark & 21Shares): $1.79M inflow – Total net inflow $2.39B

BTC (WisdomTree): $1.44M inflow

GBTC (Grayscale): $0 inflow – Continuing negative trend with a total net outflow of -$23.25B

In total, the net asset value of Spot Bitcoin ETFs has reached $133.5 billion, which corresponds to approximately 6.23% of Bitcoin’s total market capitalization.

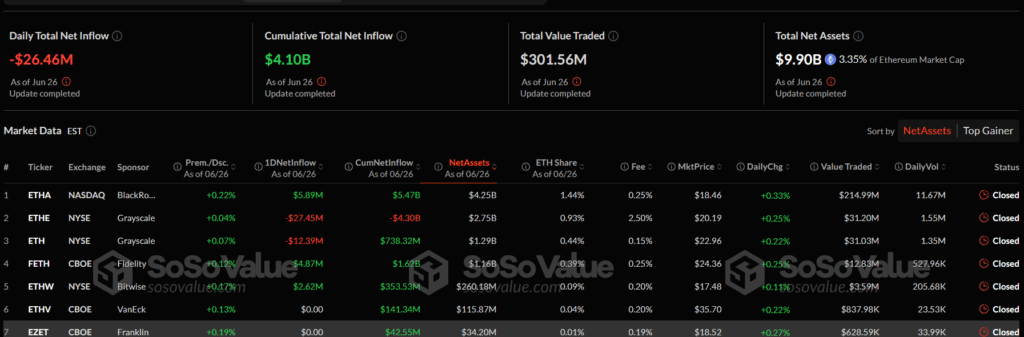

On the other hand, Spot Ethereum ETFs experienced a net outflow of $26.46 million on June 26. This outflow may indicate some investors taking short-term profits. Since there is no fully approved ETF market yet on the Ethereum side, such fluctuations are common.

- ETHE (Grayscale): -$27.45M outflow – Total net outflow -$4.30B

ETH (Grayscale): -$12.39M outflow – Total net inflow $738.32M

ETHA (BlackRock): +$5.89M inflow – Total net inflow $5.47B

FETH (Fidelity): +$4.87M inflow – Total net inflow $1.62B

In conclusion, June 26 data indicates strengthened investor confidence in Bitcoin, while investors remain cautious about Ethereum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.