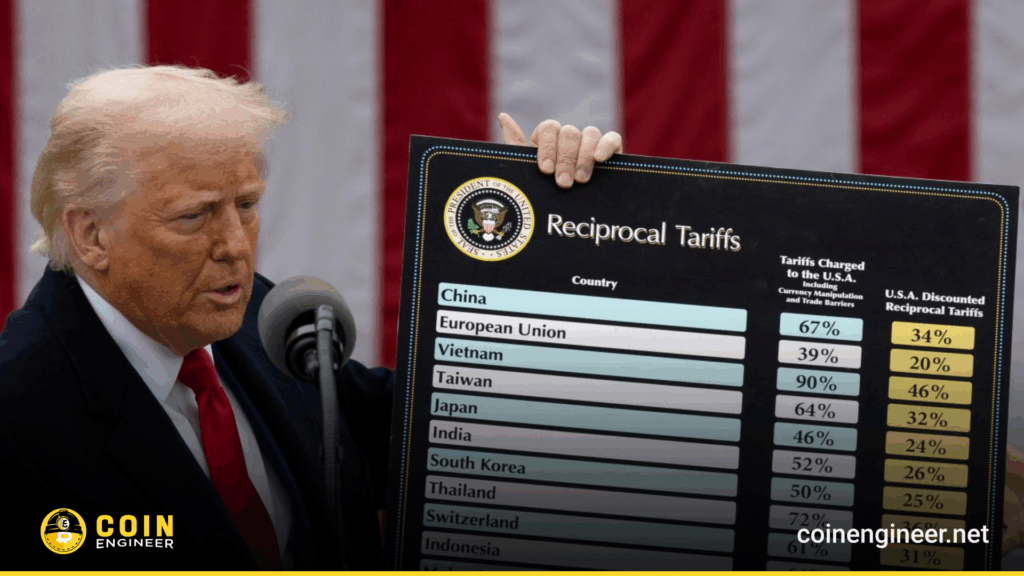

Bitcoin is heading into 2026 facing significant macroeconomic risks. President Donald Trump’s tariff agenda is among the key factors crypto investors are closely monitoring. As seen in 2025, tariff-related news can move crypto prices just as quickly as ETF flows. Several critical tariff actions expected in 2026 could steer the market, rapidly shifting investor sentiment from risk-on to risk-off.

How Did Trump’s Tariffs Affect the Crypto Market in 2025?

In 2025, tariff hikes triggered sharp sell-offs in Bitcoin and other digital assets. Following new tariffs imposed on Mexico, Canada, and China in February, Bitcoin fell to a three-week low of around $91,400. Ethereum lost 25% in just three days, while major tokens dropped more than 20% in a single day.

The “Liberation Day” tariff shock in April, combined with renewed US–China trade tensions, briefly pushed Bitcoin below $82,000. However, the crypto market rebounded after the White House signaled potential pauses, and with a temporary tariff agreement in May, Bitcoin climbed back above $100,000. In October, a 100% tariff on Chinese imports linked to rare earth tensions caused a short-term drop of more than 16% in Bitcoin.

Tariff Moves That Could Impact the Crypto Market

- The Deferred 100% China Tariff Cliff

If reactivated, this tariff would impose an additional 100% tax on all Chinese imports. Combined with weak growth and persistent inflation expectations, this could tighten financial conditions, pushing investors to reduce leverage and synchronize risk-off behavior. Such a move could trigger sharp volatility in Bitcoin prices. - Higher Global Baseline Tariffs

The possibility that Trump could raise general import tariffs beyond a 10% baseline may create sustained pressure on risk appetite in 2026. For Bitcoin, this could translate into more volatile rallies and more fragile downturns. - Digital Services Tax Retaliation Tariffs on Europe

Countries imposing digital services taxes on US tech firms could be targeted. This may pressure global equity markets, and the crypto market often mirrors such risk-off periods with rapid price movements. - Pharmaceutical Tariffs That Could Rise to 200%

Targeting imported branded or patented drugs, these tariffs aim to penalize firms that do not relocate production to the US. Investors may interpret this as an inflation risk, potentially leading to short-term liquidity tightening and selling pressure on Bitcoin. - Expansion of Secondary Tariffs Linked to Approved Trade

Secondary tariffs penalize countries that buy goods from US rivals, even if they are not direct targets. This move could raise global uncertainty, increasing volatility in Bitcoin and accelerating forced liquidations.

Assessment

Tariff measures that could affect Bitcoin in 2026 stand out as critical risk factors for crypto investors. Tariffs on China, broader global import hikes, European digital tax retaliation, and secondary trade tariffs are among the main drivers expected to increase market volatility. Investors should manage their portfolios with these risks in mind and remain prepared for potential price swings.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’ t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news.