Jan3 CEO Samson Mow warns that unit bias is heavily distorting perceptions among new crypto investors, leading them to overvalue altcoins like Ethereum, XRP, and Solana compared to Bitcoin.

Bitcoin Still Has Dominance Room

Mow claims Bitcoin dominance (63.69%) is still climbing, contradicting analysts who predicted a 60% cap by late 2024. He argues that investors fall for a psychological trap, preferring cheaper-looking assets even when they hold less value.

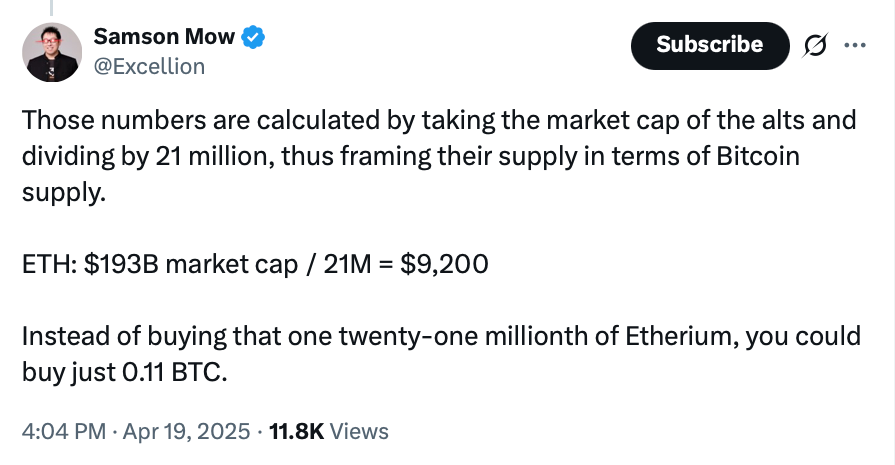

“1/21M of BTC costs ~$85,000. If alts had the same supply, ETH would be $9,200, XRP $5,800, SOL $3,400. These prices make no sense.”

High Supply Tricks Investors

According to Mow, most altcoins inflate their supply on purpose, confusing buyers who don’t understand the real market cap. He adds that unit bias is destroying the uninitiated, creating a false sense of value in altcoins.

What Happens If BTC Dominance Rises?

Bitcoin Dominance reflects the capital concentration in Bitcoin versus the rest of the crypto market. When it drops, altseason tends to start. But Mow says that Bitcoin still has much more upside before that happens.

Historical trends support a rise in Bitcoin dominance before altcoin capital rotation begins.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.