BlackRock IBIT ETF on the Rise

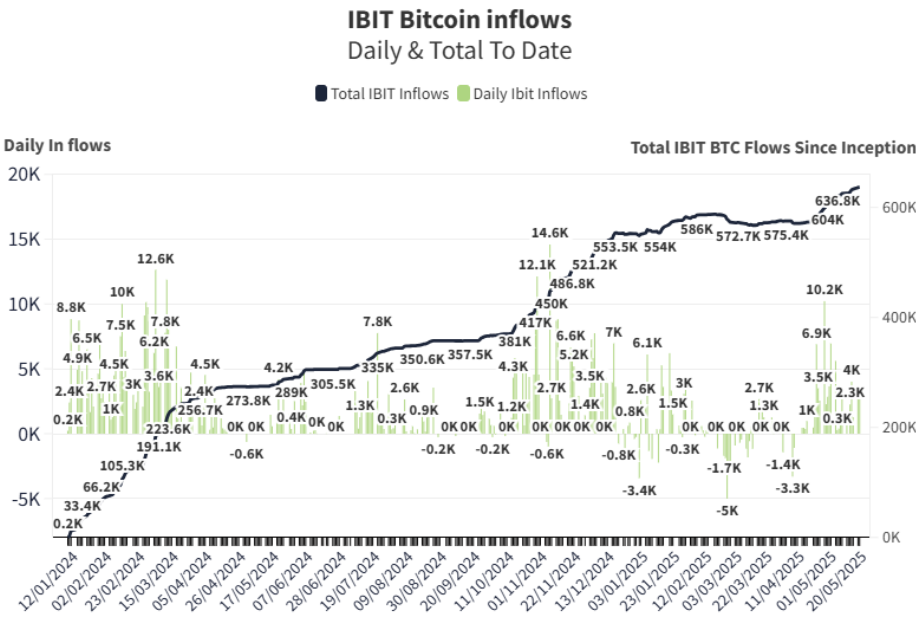

BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT), became the fifth highest capital-attracting ETF in U.S. markets in 2025. Since the beginning of the year, the fund has attracted over $9 billion in investments. Especially in recent months and weeks, it has garnered significant interest. In just four weeks, the fund received $6.5 billion in new capital. Investors are moving away from traditionally low-yield instruments toward Bitcoin ETFs with high growth potential. The leadership of a global financial giant like BlackRock supports positive expectations for the sector’s future.

Eric Balchunas states that BlackRock is currently the second-largest Bitcoin holder in the world, trailing only Bitcoin’s creator, Satoshi Nakamoto. If BlackRock continues accumulating Bitcoin at this pace through its ETF, it is expected to become the largest Bitcoin holder by next summer.

IBIT’s success is largely attributed to its low management fee and strong security measures. The fund’s management fee is set at just 0.25%, making it highly competitive compared to similar funds. Furthermore, its partnership with Coinbase Prime ensures top-level security for digital assets. BlackRock’s extensive investor network and institutional infrastructure boost IBIT’s market liquidity, enabling investors to buy and sell the fund with ease. Data from Thomas Fahrer shows that IBIT has received a total inflow of 2,705 BTC worth $287.5 million.

Comparison of IBIT and Other Bitcoin ETFs

Besides IBIT, there are various Bitcoin ETF options in the market. One of the most well-known is the Grayscale Bitcoin Trust (GBTC), managing about $10 billion in assets. However, its management fee is quite high at 2.0%. Additionally, GBTC is not a spot Bitcoin ETF. Therefore, significant discrepancies may arise between the market price and the fund’s net asset value (NAV), creating disadvantages for investors.

On the other hand, the ProShares Bitcoin Strategy ETF (BITO) and Valkyrie Bitcoin Strategy ETF are futures-based funds with different structures. These funds invest in Bitcoin futures contracts. Unlike spot Bitcoin, futures-based ETFs can show price inconsistencies from time to time. Additionally, the volatility of these funds is generally higher compared to spot Bitcoin ETFs. Their management fees are around 0.95%.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.