After years of regulatory ambiguity, a decisive move from the United States has reshaped the conversation around staking — a foundational mechanism of modern blockchain networks.

SEC Declares Protocol Staking Is Not a Securities Transaction

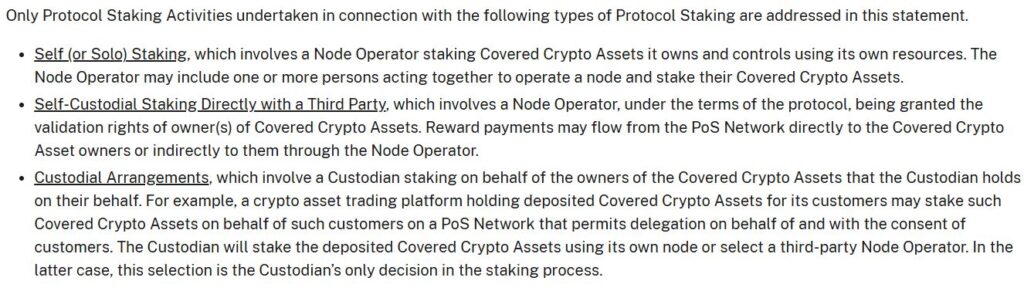

In a May 29 announcement, the SEC’s Division of Corporation Finance stated that protocol staking activities on proof-of-stake blockchains “do not require registration under the Securities Act.” This means that staking, as a blockchain function, is not considered a securities offering.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Alison Mangiero, head of staking policy at the Crypto Council for Innovation, called the development a “major step forward” for the crypto industry. “The SEC has now recognized what we’ve long argued — staking is fundamental to blockchain operation, not an investment contract,” she said.

Path Opens for Staking ETFs

The industry has long demanded clearer staking regulations. In April, the Proof of Stake Alliance submitted a detailed letter to the SEC, explaining that both custodial and non-custodial staking services are distinct from traditional investment contracts.

While the SEC recently delayed its decision on Bitwise’s Ether ETH staking ETF, analysts believe this guidance significantly improves the likelihood of approval by late 2025.

A Notable Shift in Regulatory Tone

This guidance reflects a shift away from the SEC’s previous enforcement-heavy stance. Marcin Kazmierczak of RedStone described it as an “evolutionary step,” noting that the foundation is being laid for a more structured and inclusive regulatory framework.

Since January, the SEC’s dedicated Crypto Task Force — led by Commissioner Hester Peirce — has been working on regulatory reports expected in the coming months.

Mangiero concluded, “We’ve consistently argued staking is not an investment — it’s how blockchains function. This guidance is meaningful recognition of that fact.”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.