Investor interest in the crypto space is heating up, especially in the stablecoin sector. As traditional markets seek new opportunities, one major player in the digital asset world, Circle, is stepping into the spotlight with a bold move.

Target Raised As Demand Surges

Circle, the issuer behind the popular stablecoin USDC, has officially increased its initial public offering (IPO) target to $896 million, according to a June 2 filing with the U.S. Securities and Exchange Commission (SEC). The company now plans to offer 32 million shares, up from 24 million, at a price range of $27 to $28 per share — higher than its previous $24 to $26 range.

The company has not issued public comments due to the mandatory “quiet period” before an IPO, which restricts statements that could influence investor behavior.

Stablecoin Adoption Fuels Optimism

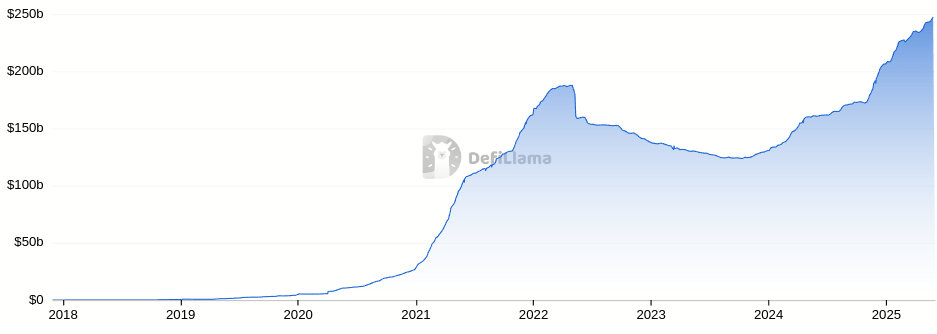

Circle’s IPO adjustment comes at a time when stablecoin usage is expanding rapidly. Between January 2023 and February 2025, a staggering $94.2 billion in stablecoin transactions have been settled. This points to the growing role of digital dollars in global payment infrastructure.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Notably, asset management giant BlackRock is reportedly planning to purchase a 10% stake in the offering — a strong vote of confidence in Circle’s long-term value.

Crypto Regulations Gaining Ground In The U.S.

Regulatory momentum in the United States is also contributing to growing investor confidence. In May, a bipartisan bill known as the CLARITY Act was introduced in Congress. It proposes a regulatory framework splitting oversight between the SEC and CFTC, while also creating a registration process for digital asset firms.

New SEC Chair Paul Atkins has also signaled a shift toward clearer crypto policies, and recent guidance on staking and futures products hints at a more structured future for the entire sector — including major tokens like Bitcoin and Ethereum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.