Ethereum has gained 46% in the last 30 days. This strong upward movement has excited investors. ETH is currently trading at around $2,630 and has gained another 7% in the past three days. Analysts suggest the rally could continue.

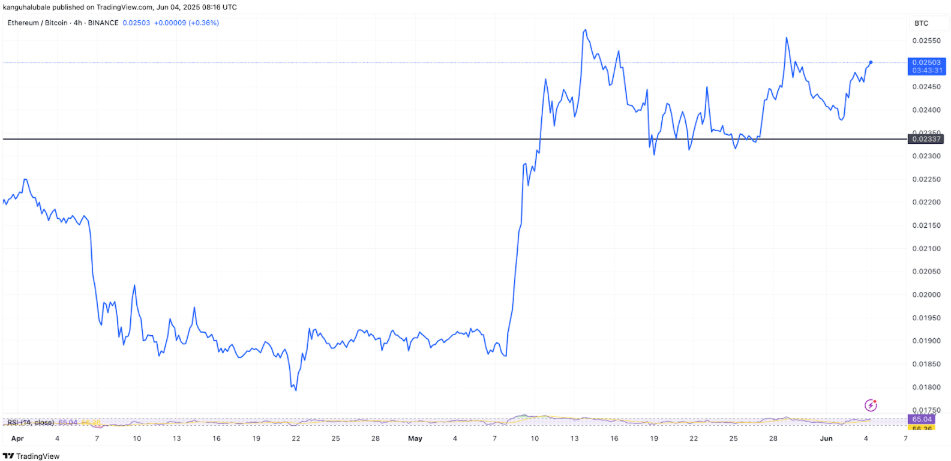

The ETH/BTC ratio is also drawing attention, having increased by 30% over the past month. On May 14, it peaked at 0.02618, the highest in 10 weeks. It currently stands at approximately 0.02503, after dropping as low as 0.01766 in mid-April.

Is a New Ethereum Rally Starting?

Popular trader Daan Crypto Trades noted that ETH/BTC is moving sideways in the 0.022–0.026 range. He stated that a breakout above this level could provide new support for ALT/BTC pairs.

“If you want to track how altcoins are performing against Bitcoin, one of the main indicators is the ETH/BTC chart,” he said.

Michael van de Poppe expressed that Ethereum is preparing for a rally. The ETH/USD pair is trading above $2,400 on the six-hour chart, marking it as a strong support level. The resistance zone lies between $2,680 and $2,850. At $2,680, there is also the 200-day simple moving average, meaning breaking this level could pave the way for new highs.

Daan Crypto Trades also reiterated that ETH/BTC is consolidating in the 0.022–0.026 range and that a breakout above this range should temporarily support ALT/BTC pairs.

“One of the key factors in tracking how altcoins perform against BTC is the strength of the $ETH/BTC chart,” he commented.

Rekt Capital emphasized the importance of the $2,500 level becoming a support zone. If Ethereum holds this area, a structure similar to the mid-2021 rally may form. Institutional interest in ETH is also increasing. Spot Ethereum ETFs have seen inflows for 12 consecutive days, indicating that institutions are turning to Ethereum.

According to CoinShares data, Ethereum investment products saw inflows of $321 million last week—the strongest weekly increase since December 2024. Meanwhile, Bitcoin ETPs experienced $8 million in outflows, ending BTC’s six-week streak of $9.6 billion in total inflows.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.