In May 2025, Bitcoin reached a new all-time high, according to the ARK Invest report. This surge was significantly fueled by a remarkable 121% increase in inflows to spot Bitcoin ETFs. Meanwhile, there were substantial outflows from gold ETFs, which are traditionally seen as safe-haven assets. This data strongly supports the shift in investor portfolios towards digital assets.

Bitcoin ETF Flows and Cautious Movement in On-Chain Data

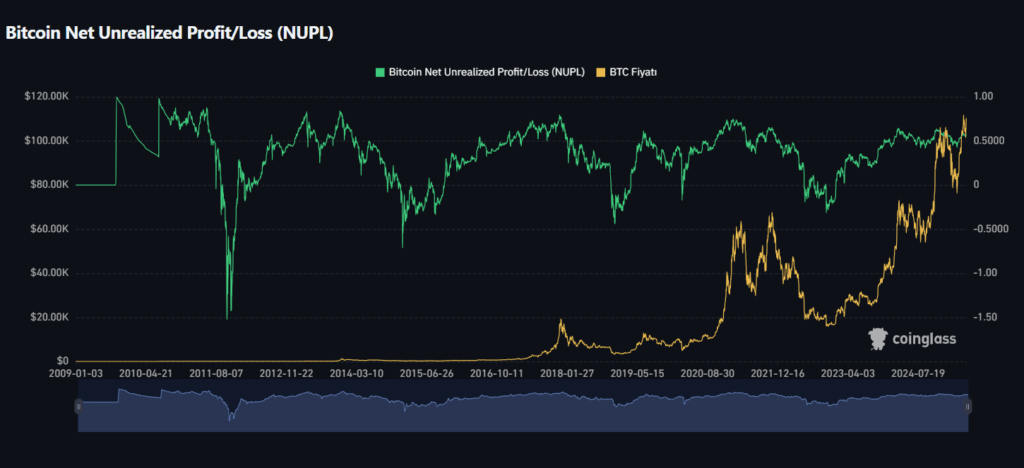

Despite the rapid rise in Bitcoin prices, on-chain data does not indicate excessive euphoria. This suggests that the market is not experiencing “irrational exuberance,” and investors are acting cautiously. Therefore, the price increase is based on solid foundations.

Furthermore, the ARK Invest report relies on Glassnode data. Bitcoin’s unrealized profits in this cycle are slightly above average. Historically, irrational exuberance has seen levels go over three standard deviations. However, such extreme excitement is not evident at present. In May, Bitcoin ETF inflows remained strong compared to gold ETFs, which fell from $9.2 billion to $1.5 billion. The value of Bitcoin-traded products increased by over 120%. On June 10, 2025, net inflows into spot Bitcoin ETFs reached $422 million, while spot Ethereum ETFs saw $125 million in inflows.

Weakening US Economy Boosts Interest in Bitcoin

In the U.S., rising costs and declining demand in the housing, automotive, and services sectors are causing economic slowdown. In this environment, Bitcoin is emerging as an alternative store of value. Known as digital gold, Bitcoin is strengthening its reputation as a safe haven during uncertain economic times.

Bitcoin Core Development Activity at a 10-Year Low

According to the report, Bitcoin Core development activity has dropped to its lowest level in the past decade. This decline indicates that Bitcoin has shifted from being a technology-driven innovative project to a stable and reliable monetary asset. Bitcoin is now more prominent as a store of value and a medium of exchange rather than a tech development platform.

The record level Bitcoin reached in May 2025 was critically influenced by investor interest in spot Bitcoin ETFs. The 121% increase in ETF inflows demonstrates the growing strength of digital assets compared to traditional investment tools. On the other hand, the outflows from gold ETFs—previously seen as a safe haven—signal a change in investor risk perception.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.