The world of cryptocurrencies is more than charts, prices, or news feeds. Certain indicators help us understand the emotional pulse of the market, providing a window into investor behavior. One such indicator is the Fear and Greed Index, often seen as a mirror of market psychology.

What Is the Fear and Greed Index?

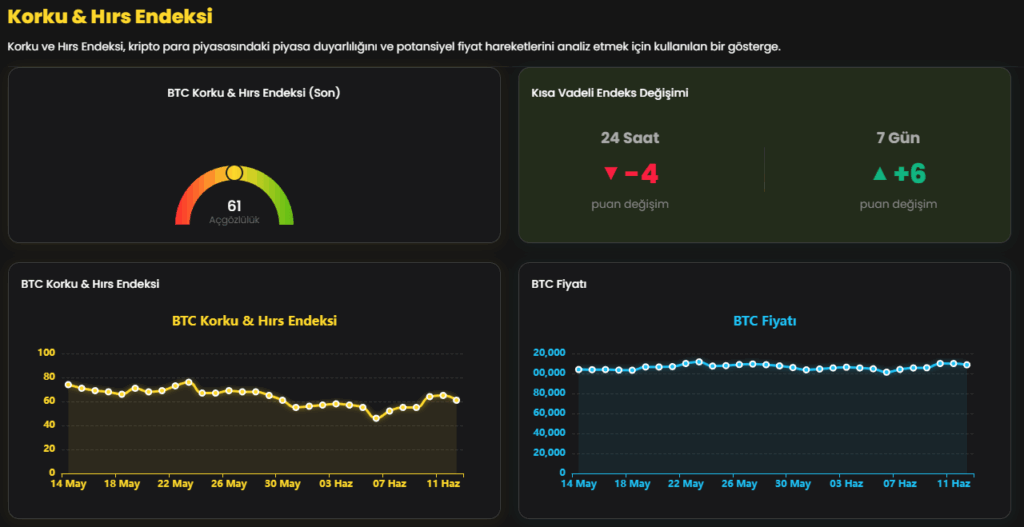

The Fear and Greed Index measures and analyzes investor sentiment in the market. Though also used in traditional finance, it’s especially popular in the crypto space, mainly focusing on Bitcoin. With a range from 0 to 100, it helps identify periods dominated by emotional decisions.

- 0–24: Extreme Fear

- 25–49: Fear

- 50–74: Greed

- 75–100: Extreme Greed

As shown in the chart above, a current value of 61 indicates a period of greed, reflecting strong risk appetite among investors.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

How Is It Useful? How Should It Be Interpreted?

The Fear and Greed Index reflects collective investor behavior, helping traders and analysts make informed decisions. For instance:

- Extreme fear usually aligns with market sell-offs and can present buying opportunities for long-term investors.

- Extreme greed often indicates market overconfidence and the potential for corrections.

That’s why many experts recommend a contrarian approach: “Buy when there’s fear, sell when there’s greed.”

Why Should You Monitor the Fear and Greed Index?

Crypto markets are highly reactive to news, social media, and sudden events. Since price movements often reflect emotions more than fundamentals, tools like the Fear and Greed Index are vital for identifying emotional swings.

Sharp moves in major coins like Bitcoin or Ethereum can cause the index to shift dramatically. For short-term traders, these changes can offer valuable timing insights for entering or exiting positions.,

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.