Companies Expand Bitcoin Treasury Strategies

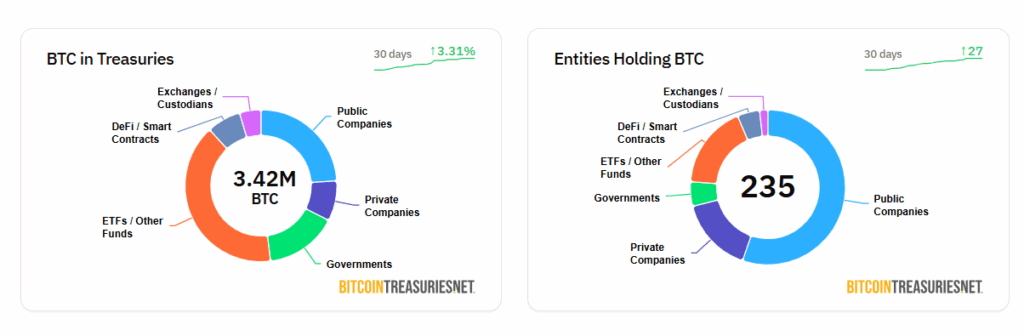

Over 60 companies globally have announced that they have added or plan to add Bitcoin (BTC) to their treasury portfolios. This marks a rapidly growing adoption trend in the corporate world. Between June 9-13, these companies made significant Bitcoin treasury announcements that stirred the market. Collectively, they added more than 2,500 BTC and aim to purchase an additional $1.8 billion worth in the future. Publicly shared documents indicate that Bitcoin is being increasingly adopted as part of the global financial infrastructure.

New and Existing Firms Strengthen Their Bitcoin Treasuries

@btcNLNico shared on X that 60 major Bitcoin-related announcements were made globally between June 9-13. The Bitcoin Treasury Strategy is entering a rapid growth phase as more companies integrate BTC into their financial frameworks.

This week, six new companies officially launched their Bitcoin treasuries, adding a total of 404 BTC to their balance sheets. These companies include American Bitcoin Corp, Bitmine, and Gumi.

Ten more companies announced plans to establish Bitcoin treasuries in the future. Trump Media filed a registration for a $2.3 billion Bitcoin Treasury Deal. Mercury Fintech revealed a $800 million funding plan.

Twenty-three companies added BTC to their existing holdings, acquiring a total of 2,188 BTC. The most active participant was Strategy, which added 1,045 BTC and also completed a $979.7 million IPO on June 10. Other notable purchases included 279.9 BTC by Remxpoint, 118.6 BTC by KULR, and 111 BTC by Cipher Mining. Even smaller firms like Vanadi Coffee and Rocksoft added between 1 and 10 BTC. This surge in institutional demand also mirrors the recent Bitcoin ETF trend—for instance, BlackRock’s IBIT alone recorded nearly $1 billion in inflows this week.

Expanding Bitcoin Strategies and Future Projections

Nine companies recently outlined plans for further BTC acquisitions, potentially leading to $1.83 billion in Bitcoin purchases. For example, ANAP conducted a capital increase involving 585 BTC. Melioz raised $32.5 million and structured a warrant mechanism that could support an additional $69.48 million BTC purchase.

Other key developments include GameStop’s issuance of $2.25 billion in convertible bonds for Bitcoin investments. In France, The Blockchain Group launched a €300 million capital program, with shareholder approval to raise up to €10 billion.

DDC Enterprise and H100 Group plan to tokenize assets and use Bitcoin as collateral. Some companies announced their plans to list on U.S. OTC markets. The Smarter Web Company stands out as a key example in this field. Increasingly, more companies are embracing Bitcoin as a core treasury and growth strategy. The data shared by

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.