New Record Expectations for Gold Prices

Bank of America (BofA), in its analysis note dated June 13, stated that the price of gold could reach $4,000 within the next 12 months. This forecast is above the current projections from Wall Street. The bank highlighted that rising concerns over the financial stability of the U.S., interest rate volatility, and a weakening dollar are supporting this rise.

According to BofA, increasing market uncertainty and unsustainable levels of public debt are driving demand for gold.

“Fluctuations in interest rates and a weak U.S. dollar will keep gold prices strong, especially if the Treasury or Fed needs to support the market.”

Central Banks and Geopolitical Risks Support Gold

Positive expectations for gold are not limited to BofA. Goldman Sachs predicts gold will reach $3,700 by the end of 2025 and $4,000 by mid-2026. This forecast is supported by structural central bank purchases and geopolitical tensions.

“Interest rate volatility and geopolitical risks are positive factors for gold. The weakening U.S. dollar also increases gold’s value among investors.” (Bloomberg Markets, June 2025)

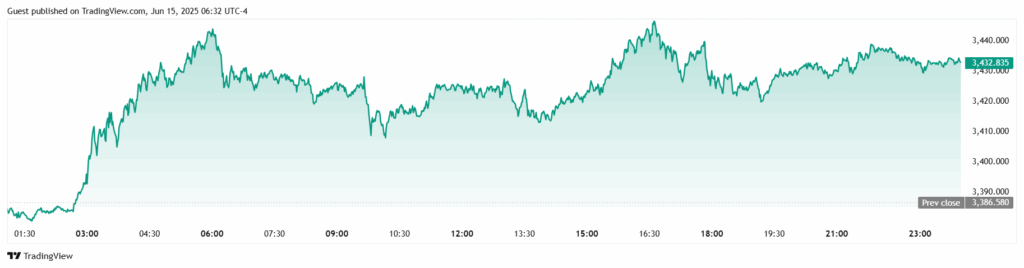

In recent weeks, escalating conflicts between Israel and Iran have driven investors towards safe havens. Due to these developments, gold has approached the $3,500 level, gaining more than 30% since the beginning of the year.

Meanwhile, Goldman Sachs Metals & Mining Research report states:

“Expansionary monetary policies by central banks and global geopolitical uncertainties are driving gold prices higher. The depreciation of the U.S. dollar further enhances gold’s appeal.”

Additionally, inflation data released in the U.S. also supported gold. The Producer Price Index (PPI) increased by 2.6% year-over-year in May. Core PPI fell to 3%, strengthening expectations for Fed rate cuts. This situation makes gold more attractive as a hedge against inflation.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.