Chinese Bitcoin mining companies Bitmain, Canaan, and MicroBT are relocating their manufacturing operations to the U.S. as a result of tariffs imposed by the Trump administration. Controlling 90% of the global Bitcoin mining hardware market, these three firms are developing new strategies to counter the challenges of the trade war.

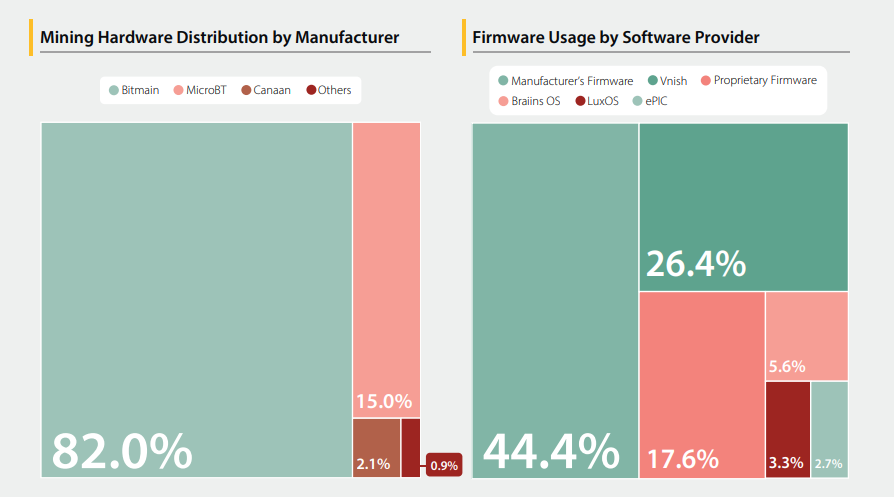

A study published in April by the University of Cambridge revealed that Bitmain is responsible for 82% of global Bitcoin hardware production. MicroBT holds a 15% share, while Canaan contributes 2%. Together, these three Chinese companies dominate 99% of the Bitcoin mining hardware market. Notably, Bitmain has already started production in the U.S., while Canaan and MicroBT are actively working on similar localization plans.

Structural Changes in the Supply Chain and Political Impacts

The U.S.-China trade war is triggering structural changes in the mining hardware supply chain. In addition, Trump’s crypto-friendly policies and campaign promises to promote Bitcoin mining within the U.S. provide significant advantages for Chinese miners. Guang Yang, CTO of Conflux Network, emphasizes that these changes are deep and long-lasting, noting that American firms are now turning to “politically acceptable” sources for hardware.

Security Concerns and Localization Efforts in the U.S.

Auradine, a U.S.-based Bitcoin miner and hardware manufacturer backed by MARA Holdings, is lobbying for restrictions on Chinese supplies. Sanjay Gupta, Chief Strategy Officer at Auradine, said:

“Although over 30% of global Bitcoin mining takes place in North America, more than 90% of mining hardware comes from China. This creates a major imbalance between geographic demand and supply.”

“Having hundreds of thousands of China-made mining devices connected to the U.S. power grid poses a significant security risk.”

Despite a trade agreement signed between the U.S. and China last week, the impact of Trump-era tariffs continues to affect the industry. Chinese miners aim to overcome cost and security issues through their new production bases in the U.S.

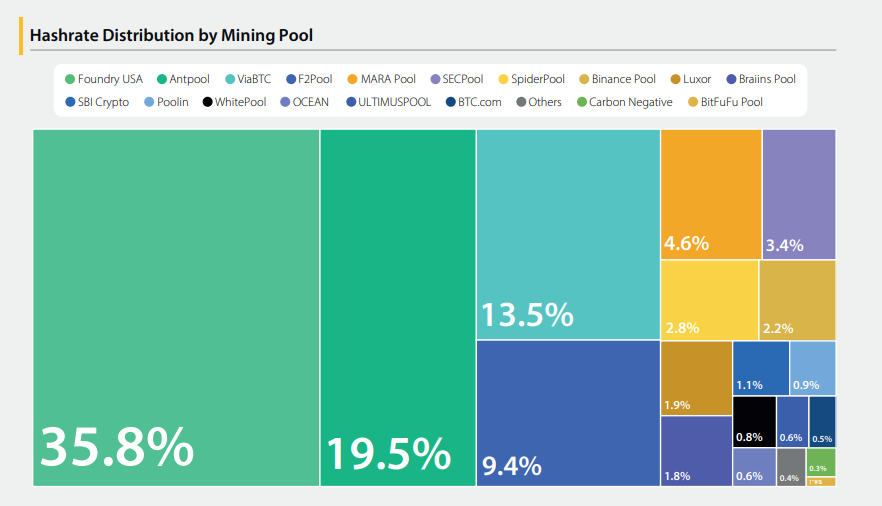

Hardware Market Share by Manufacturer

Hashlabs Mining CEO Jaran Mellerud analyzed the Trump administration’s comprehensive tariffs in early April. According to him, these tariffs have led to a sharp decline in U.S. demand for Bitcoin mining equipment. Additionally, the tariffs benefit mining operations outside the U.S., as manufacturers prefer to sell excess inventory abroad at lower costs.

This development represents a major restructuring in the global crypto hardware market. The establishment of operations in the U.S. by Chinese firms not only helps them avoid customs duties but also aims to address potential geopolitical concerns surrounding Chinese technology.

After China’s 2021 crackdown on crypto mining, the U.S. emerged as a leading Bitcoin mining hub. This shift has created a natural market for hardware manufacturers. However, it remains uncertain whether U.S.-based production can compete with China-made ASICs in terms of price.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates