In the last 24 hours, spot Bitcoin ETFs in the US saw an inflow of $350.6 million. BlackRock’s IBIT and Fidelity’s FBTC ETFs attracted significant investor attention, highlighting Bitcoin’s continued role as a safe haven for traditional investors.

Ethereum ETFs Continue Their Steady Rise

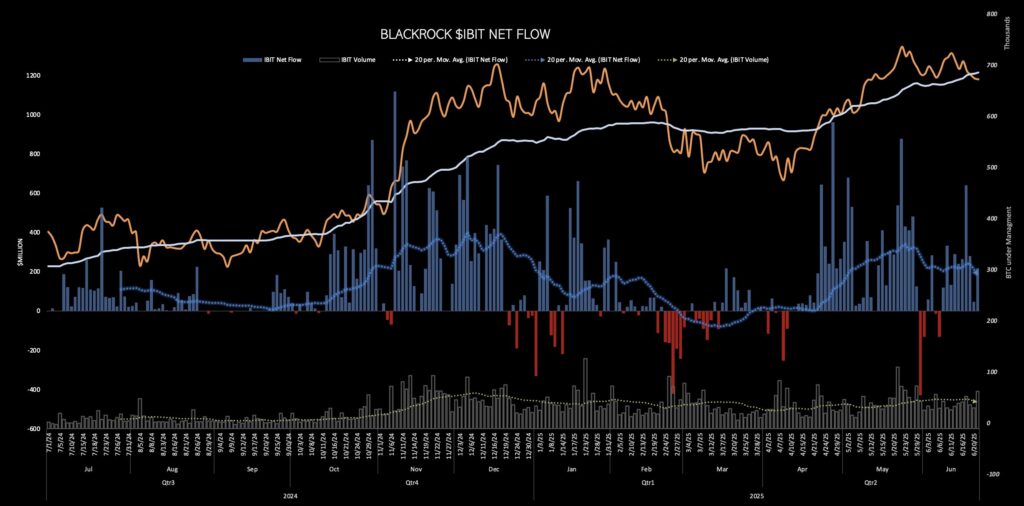

BlackRock’s IBIT product alone received $217 million in investments during yesterday’s trading session. Fidelity’s FBTC ETF recorded $105 million, while Bitwise saw a net inflow of $15 million. Overall, spot Bitcoin ETFs attracted a total of $350 million.

BlackRock’s Ethereum ETF, ETHA, stood out with a $102 million inflow, signaling rapidly growing institutional confidence in Ethereum. Additionally, Ethereum ETFs have seen positive inflows for six consecutive weeks, marking their strongest period since their September 2024 launch.

Total assets under management (AUM) for Ethereum ETFs have reached $3.9 billion. Ethereum’s staking feature and smart contract infrastructure continue to strengthen its position among financial instruments.

Strong Two-Month Trend for Bitcoin ETFs

Spot Bitcoin ETFs have experienced daily positive inflows since April 17, 2025. During this period, total inflows have exceeded $11.2 billion. Institutional investors are shifting from short-term trading to long-term strategies.

These investments demonstrate that Bitcoin is accepted not only as digital currency but also as a secure investment vehicle. The inflow volume supports the belief that Bitcoin’s price will remain above $105,000.

Spot ETFs Change Crypto Market Psychology

As institutional investors move towards spot ETF products, trust in the crypto market grows. This confidence encourages retail investors to take bolder actions. Moreover, these products facilitate easier integration of cryptocurrencies into the traditional financial system.

This transition not only shifts market perception but also enables broader acceptance of technologically advanced cryptocurrencies like Ethereum. Furthermore, mechanisms like staking provide passive income to investors, accelerating demand for Ethereum ETFs.

In the last 24 hours, $450 million flowed into BTC and Ethereum ETFs, demonstrating how pivotal institutional capital will be for the future of crypto assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.