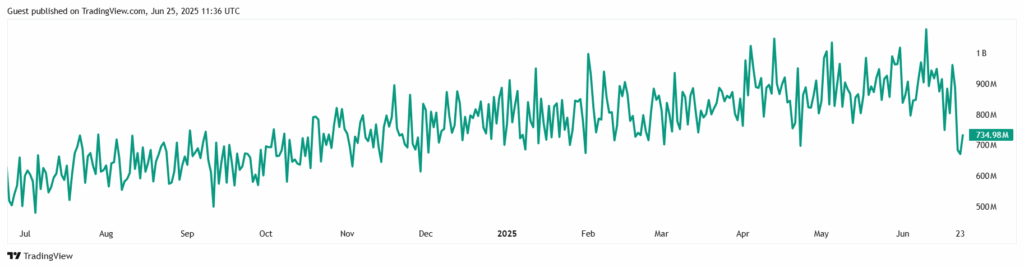

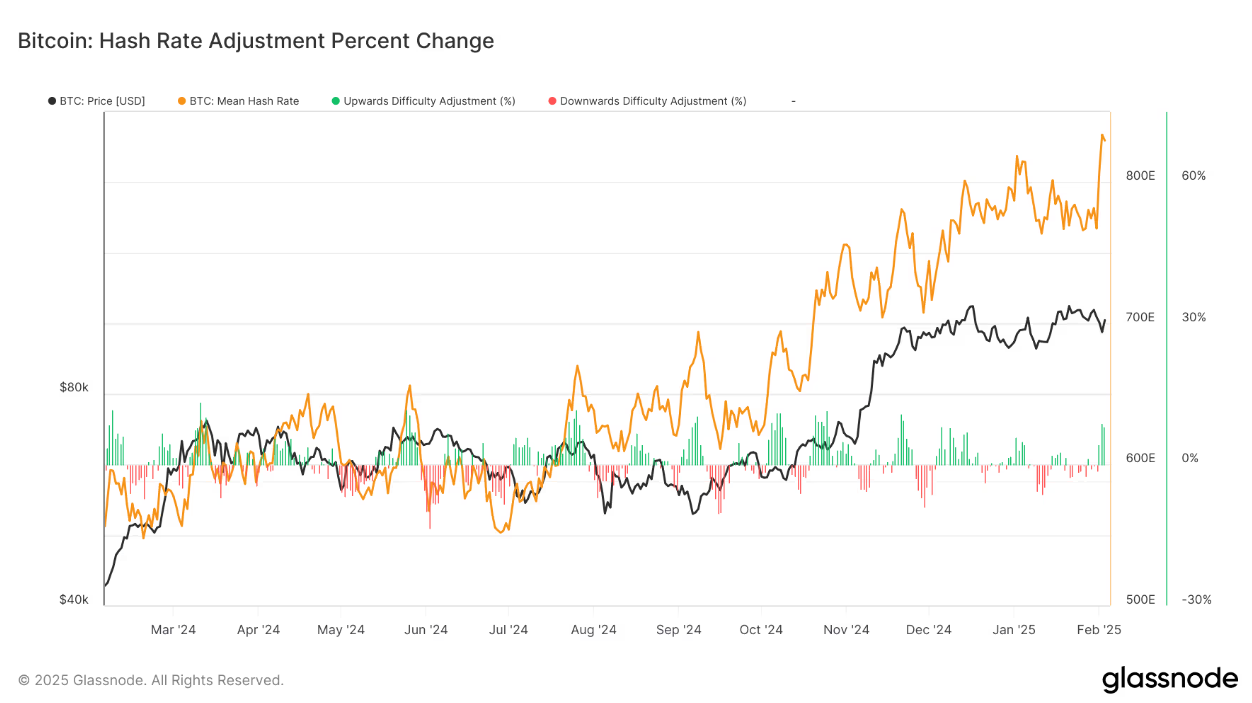

Bitcoin’s daily average hashrate has declined to 684.48 EH/s, according to BitInfoCharts data. This is the lowest level recorded since mid-October last year. It marks a significant drop from the peak of 966 EH/s reached on June 20, 2025. However, this decline does not entirely threaten the security of the Bitcoin network, as it is still high compared to the 379.55 EH/s value in July 2023.

The primary reason for the hashrate drop is the increase in Bitcoin mining costs. Mining expenses rose by more than 34% in Q2 2025. Increases in electricity prices, hardware, and maintenance costs have forced many miners to suspend operations. Additionally, some mining farms joining energy-saving programs and the conflict in Iran have also impacted the hashrate.

Twitter user Rob Waren commented, “The claim that hashrate dropped due to conflicts in Iran is funny, but weather conditions are more decisive in mining.”

Bitcoin Prices and Mining Difficulty

Despite the current hashrate situation, Bitcoin prices hover around $106,000, indicating continued investor confidence. Major Bitcoin ETFs like BlackRock, with $70 billion in assets under management, support Bitcoin’s perception as a safe haven. The Bitcoin market remained stable despite declines in U.S. stock markets.

On the other hand, mining difficulty will decrease by 9.37% on June 29, 2025. According to CoinWarz, difficulty will drop from 126.41 T to 114.40 T. This will increase mining profitability and may attract miners back to the network. However, if the hashrate does not recover, small risks to network security could arise. Currently, 684.48 EH/s provides sufficient protection against 51% attacks.

While the hashrate drop serves to eliminate inefficient miners in the long term, Bitcoin’s stable price near $106,000 and the growth of ETFs support positive market expectations. However, if the hashrate falls further and difficulty adjustment is delayed, selling pressure from miners could negatively impact prices. Furthermore, geopolitical tensions and Fed’s interest rate policies remain key macroeconomic factors influencing the crypto market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.