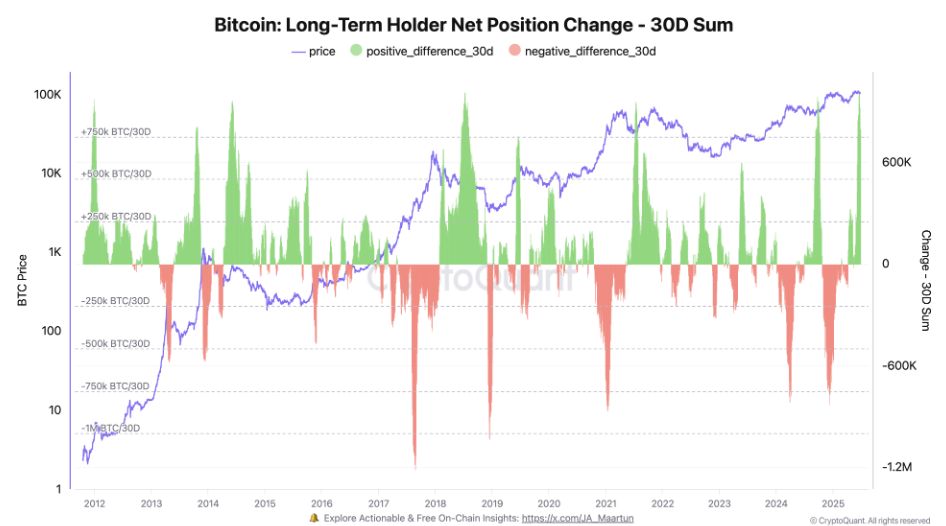

According to CryptoQuant data, the supply of long-term Bitcoin holders has surged by 800,000 BTC in the past 30 days, reaching a record high. Historically, such increases have occurred just before major price rallies.

Historic Increase in Bitcoin Long-Term Holder Supply

On-chain analytics platform CryptoQuant reported that long-term Bitcoin holders (LTH) have increased their supply by 800,000 BTC over the last 30 days. This marks the largest recorded increase in Bitcoin history. LTH refers to investors who hold their BTC for at least six months. This surge indicates high confidence in the market.

According to CryptoQuant data, a 750,000 BTC increase has only happened six times. The most recent two occurrences were in July 2021 and September 2024—both just before significant price surges.

Analyst Darkfost stated that this is a signal that should not be ignored. Most coins were purchased in the $95,000–$107,000 range, which creates a strong support level for the price.

“This is definitely a strong signal that should be included in any strategy.”

Critical Support for Bitcoin: $93,000 Level

Short-term holders (STH), who typically hold BTC for less than six months, have a cost basis just below $100,000. Glassnode emphasized that the $93,000–$98,000 range is a critical support zone. According to analysts, if BTC remains within this range, the bullish market structure will be maintained. However, if this level is broken, selling pressure could increase. Following the recent pullback, the price dropped to as low as $98,000. Despite this, the strong position of long-term holders shows the market remains resilient.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.