Under the leadership of Michael Saylor, Strategy has purchased Bitcoin for 11 consecutive weeks since April 14. On June 23, the company acquired 245 BTC for $26 million, increasing its total holdings to 592,345 BTC.

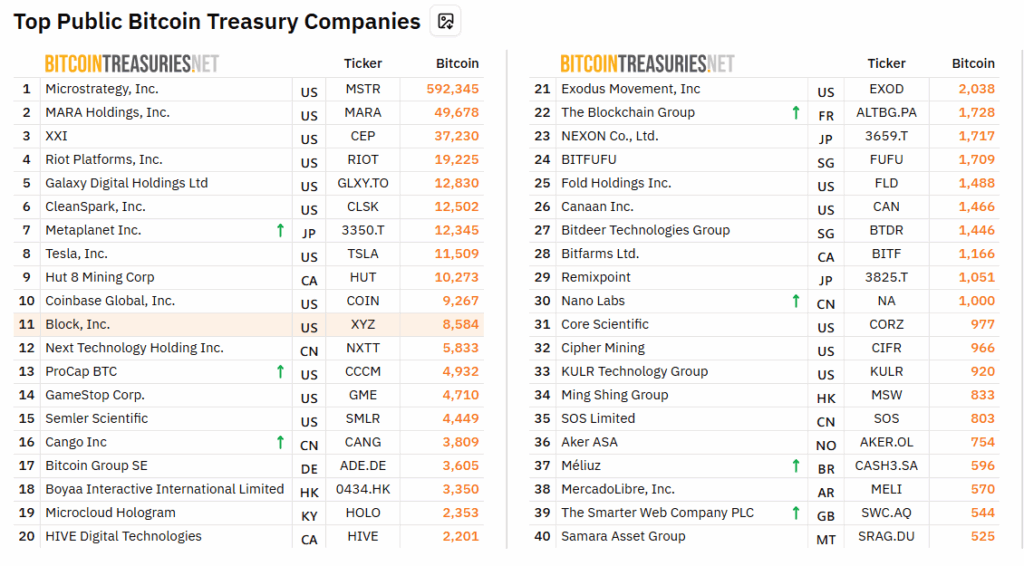

The current value of this amount has exceeded $63.6 billion. Strategy thus maintains its title as the world’s largest institutional Bitcoin investor. Moreover, the company’s BTC holdings have surpassed the combined total of the next 20 public BTC investors.

Strategy’s BTC Gains Reach $21.8 Billion

The company’s Bitcoin investment has yielded a 52% return to date. This translates to approximately $21.8 billion in unrealized profit. On the social media platform X, Saylor told his 4.4 million followers, “You’ll wish you bought more 21 years from now.”

https://twitter.com/saylor/status/1939293144014606543

Meanwhile, Saylor has gained 1 million new followers over the past year alone, reflecting his growing influence in the Bitcoin community. Strategy continued buying even during the previous bear market, indicating its long-term approach.

New BTC Investors Will Struggle, Only the Strong Will Survive

The outlook is more challenging for new BTC investors outside Strategy, especially those acquiring Bitcoin through leverage. Breed, a venture capital firm, noted that new companies would face tough conditions such as high leverage and difficult financing. According to analyses, companies unable to withstand price drops will be eliminated, while stronger ones will acquire them, leading to consolidation in the sector. Strategy is in a more resilient position due to having weathered the previous bear market. Analyst Jeff Walton estimates a 91% chance that Strategy will be included in the S&P 500 in Q2 of 2025.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.