The financial world is seeing a major shift. Central banks, once skeptical of crypto assets, are now taking bold steps toward integrating them into traditional portfolios. One of the most striking examples of this transformation comes from the heart of Europe.

A Strategic Entry Into Crypto

In Q2 2025, the Czech National Bank adjusted its U.S. investment portfolio by making a notable move: it purchased over $18 million worth of Coinbase shares, marking its first direct exposure to the crypto industry.

According to a recent 13F filing submitted to the U.S. Securities and Exchange Commission, the bank acquired 51,732 Coinbase shares. In addition, it expanded its holdings in data analytics firm Palantir by buying 49,135 more shares, bringing its total to 519,950.

This strategic allocation reflects growing interest in both Nasdaq-listed tech firms and the broader potential of blockchain-based platforms.

Coinbase Joins the S&P 500

In May 2025, Coinbase made headlines by becoming the first crypto-native company to join the S&P 500, a landmark moment signaling institutional trust in the digital asset sector.

You Might Be Interested In: Sonic SVM Research: Can New Stablecoins Shake Up the Old Order?

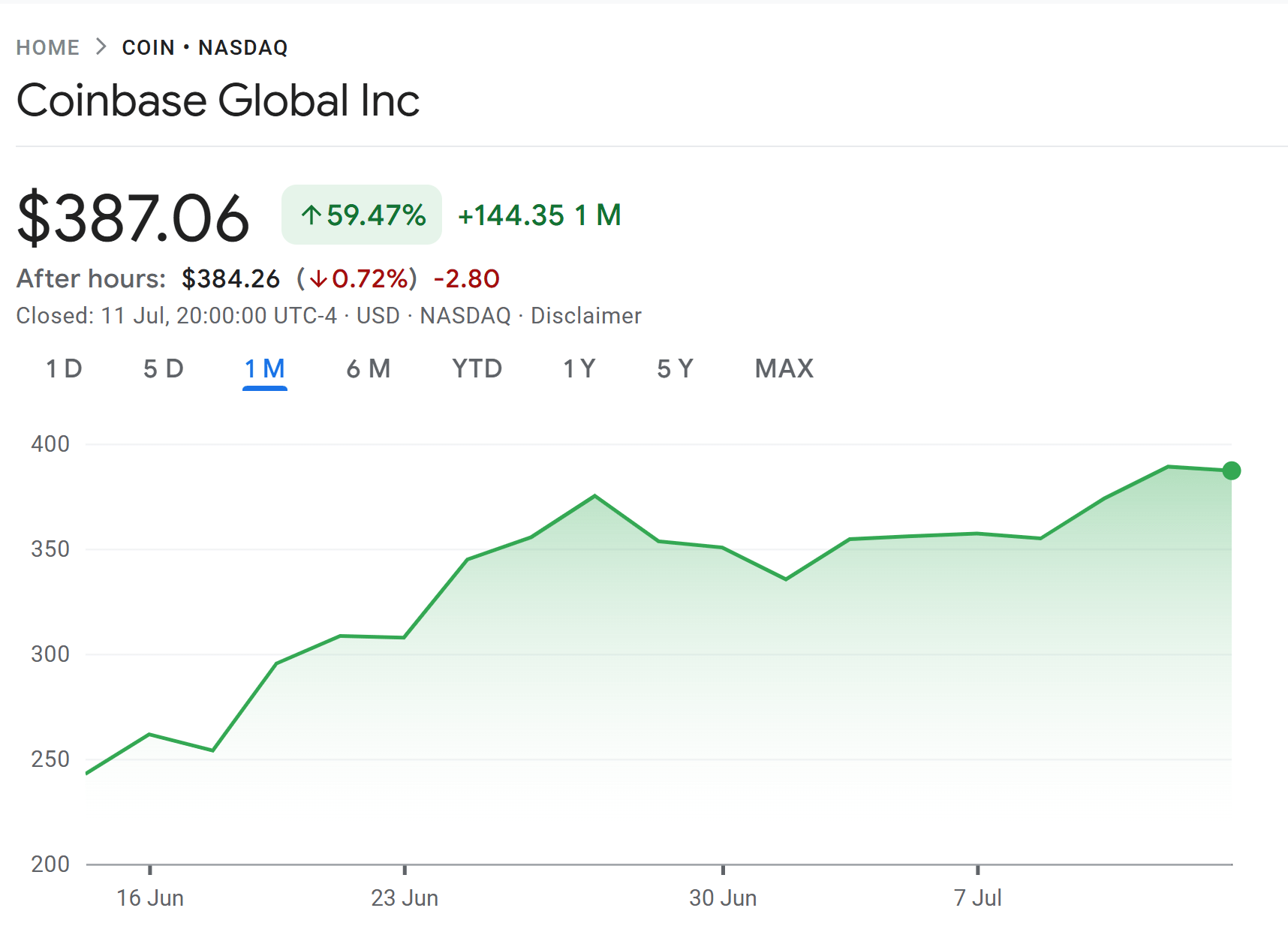

The stock soared 41% in the first half of the year, followed by another 10% gain in subsequent weeks. Over the past month, Coinbase shares surged approximately 60%, according to Google Finance data.

Revenue Drop Doesn’t Stop Growth

Despite a 10% quarter-over-quarter revenue drop to $2 billion and a 95% plunge in net income due to a $596 million paper loss, the company still beat analyst expectations with earnings per share of $1.94.

Coinbase continues expanding, recently announcing the $2.9 billion acquisition of crypto options platform Deribit. Earlier this month, it also acquired Liquifi, a token management solution, reinforcing its dominance across both trading and token infrastructure services.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.