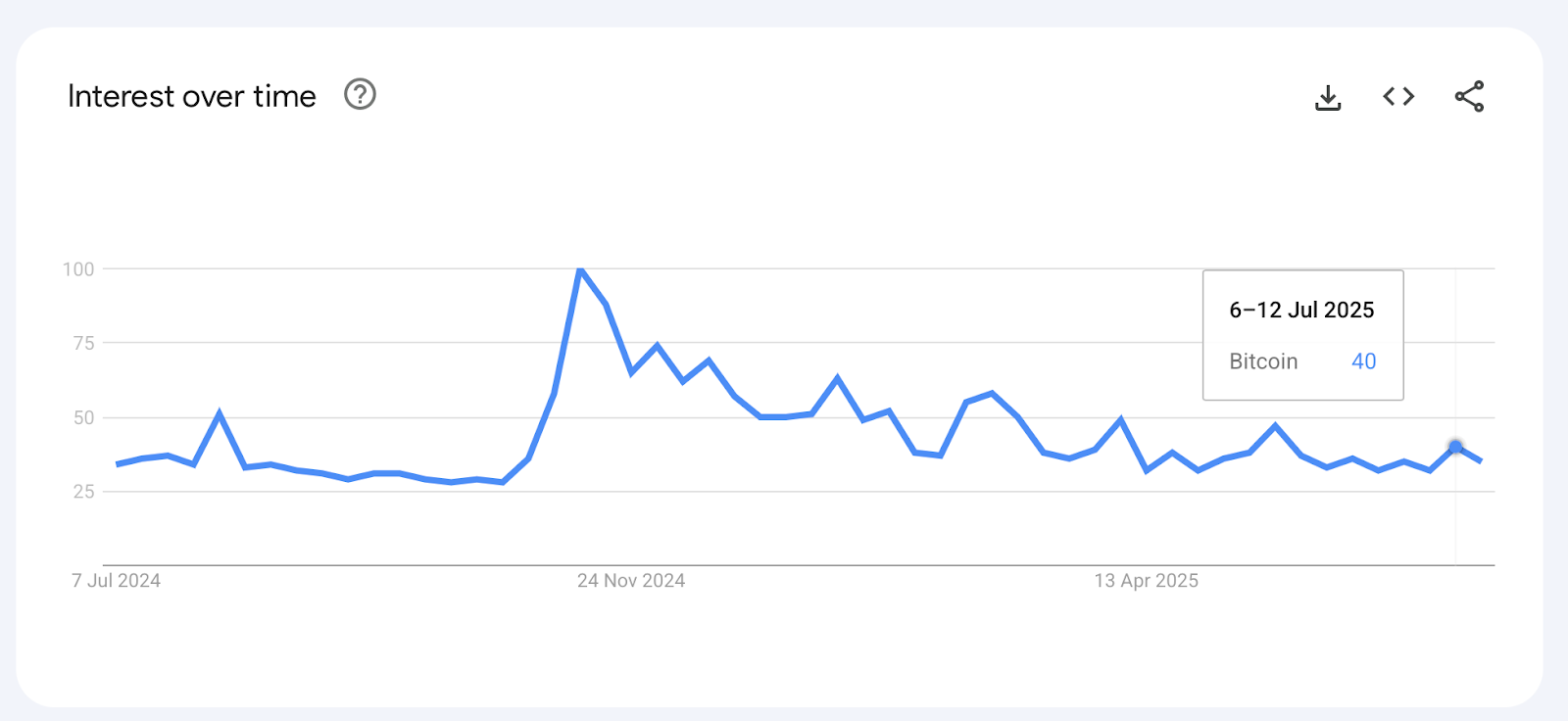

Despite Bitcoin reaching consecutive record highs this week, retail investors are noticeably absent. Google search interest for “Bitcoin” is significantly lower than previous peaks, particularly the week following the U.S. presidential election in November 2024.

Instead, demand is being driven by institutions. For the first time ever, spot BTC ETFs recorded over $1 billion in inflows on two consecutive days.

Institutional Inflows Take the Lead

Bitwise’s Head of Research, André Dragosch, emphasized in a recent post that this latest rally is led by institutional capital. Google Trends data supports this, showing just an 8% increase in searches for “Bitcoin” compared to a 60% surge in November 2024.

You Might Be Interested In: Sonic SVM Research: Can New Stablecoins Shake Up the Old Order?

Analysts suggest that retail investors may believe they’ve already missed the opportunity to buy. As Lindsay Stamp commented, many see Bitcoin at $117K and assume it’s too late to enter the market.

Onchain Data Suggests Institutional Dominance

ETF data confirms this new narrative. According to Farside Investors, spot BTC ETFs saw a $2.72 billion inflow over the past five trading days. Analyst Willy Woo remains optimistic, claiming the rally has “plenty of legs left.”

With institutional actors leading the charge, the structure of the crypto market could be undergoing a fundamental shift — one where retail plays a smaller role than ever before.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.