Tokyo-based investment firm Metaplanet made a striking move after the price of Bitcoin (BTC) hit a new all-time high of $121,500 on July 14, 2025. The company purchased 797 more BTC at an average price of $117,451, strengthening its crypto portfolio. This brings Metaplanet’s total BTC holdings to 16,352 BTC, with the latest purchase costing approximately $93.6 million.

CEO Simon Gerovich stated that they acquired 3,002 BTC last week and 7,464 BTC over the past month, pushing their year-to-date BTC return to 435.9%. Metaplanet’s total Bitcoin investment is now worth $1.64 billion, indicating an average acquisition price of $100,191 per BTC.

Bitcoin has gained 10.5% in the last week, surpassing the $121,000 level. This uptrend supports Metaplanet’s long-term BTC strategy. The firm is frequently dubbed “Japan’s MicroStrategy.”

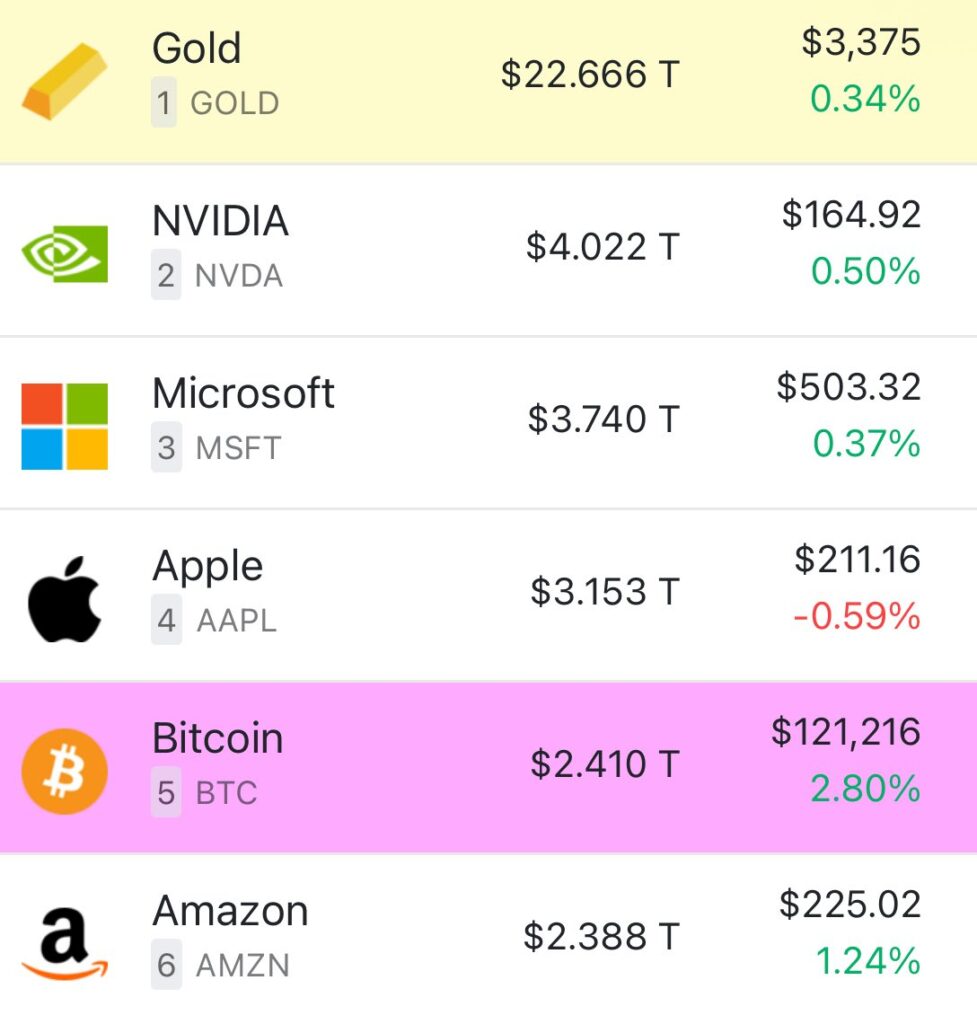

Bitcoin Market Cap Surpasses Amazon and Alphabet

With Bitcoin’s market cap exceeding $2.4 trillion, it now ranks ahead of tech giants like Amazon (NASDAQ: AMZN) and Alphabet Inc. (NASDAQ: GOOG). Meanwhile, daily trading volume surged 33% to $60 billion, and open interest in BTC futures reached $86.1 billion. According to Coinglass, $290 million in positions were liquidated in the past 24 hours, $281 million of which were shorts.

Despite the surge in BTC value, Metaplanet shares had a muted start to the week. However, analysts at Benchmark set a price target of 2,400 JPY for Metaplanet stock, indicating a 50% upside from its current level of 1,596 JPY. Additionally, with today’s BTC purchase, the company’s mNAV (market Net Asset Value) dropped to 3.78, making its stock more attractive to investors due to the growing BTC reserves.

Meanwhile, MicroStrategy CEO Michael Saylor announced on July 13 that he would resume BTC purchases. This move reflects growing institutional demand for Bitcoin. Notably, spot Bitcoin ETFs received $2.7 billion in inflows last week, supporting this upward trend.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.