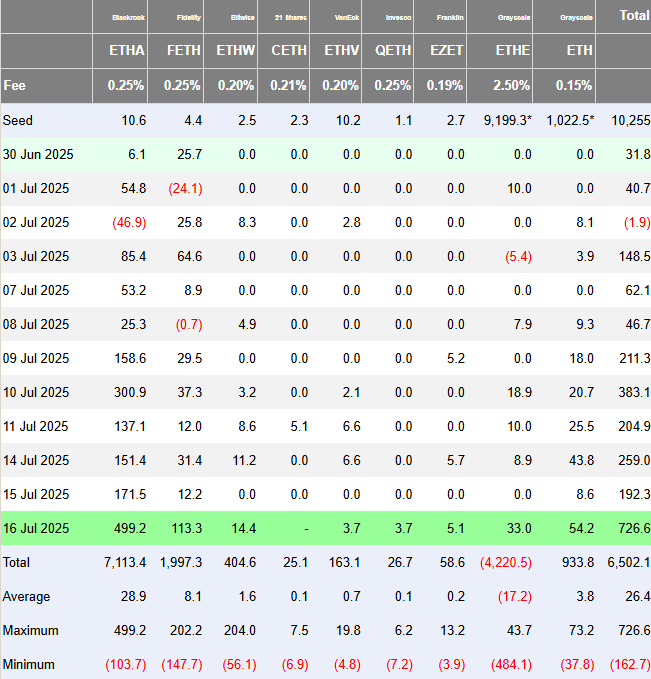

Spot Ethereum ETFs in the US recorded $726.6 million in net inflows on July 16, 2025. This marked the largest single-day inflow ever for spot Ether ETFs. The day’s leader was BlackRock, which funneled $499 million into its ETHA fund.

On the same day, Bitcoin ETFs also saw strong performance, with $779.6 million in net inflows. BlackRock’s ETHA fund was the main driver of Ethereum’s record, while Fidelity’s FETH fund ranked second with $113 million in net inflows. This surge surpassed the previous record of $428 million on December 5, 2024, by more than 70%.

The momentum wasn’t limited to ETFs. Institutional investors also made direct ETH purchases. SharpLink Gaming acquired $68 million worth of ETH in the last 24 hours and has invested a total of $343 million in Ethereum over the past eight days.

Institutional Buying Continues: Trump-Backed ETH Purchase

World Liberty Financial, backed by Donald Trump, made another Ethereum purchase. The fund bought ETH worth $5 million at an average price of $3,266. This move surpassed the purchase levels seen between November 2024 and March 2025.

According to data shared by Trader T., Ethereum ETFs now hold more than 5 million ETH in total, representing over 4% of Ethereum’s circulating supply. Meanwhile, the ETH price was trading at $3,425 at the time of writing.

Institutional Confidence in Ethereum ETFs Strengthens

The overall altcoin rally has redirected investor attention back to Ethereum. These massive inflows into spot Ether ETFs demonstrate the strength of institutional confidence.

Moves by BlackRock, Fidelity, SharpLink Gaming, and World Liberty Financial highlight long-term belief in Ethereum’s potential. Meanwhile, according to CoinShares, $3.7 billion in net inflows entered crypto asset products last week, with most of it directed toward Bitcoin and Ethereum ETFs.

Weekly inflows into Ethereum ETFs alone have reportedly exceeded $1 billion. This trend sends a strong signal reinforcing Ethereum’s position in the digital asset landscape.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.