Robert Kiyosaki continues to grab attention with his ongoing economic warnings. In his latest statement, he emphasized that the giant bubbles in the U.S. economy are about to burst. According to Kiyosaki, this development will not only impact stocks but also severely affect assets such as Bitcoin, gold, and silver.

The Rich Dad Poor Dad author noted that the downturns will offer opportunities for investors. He sees potential pullbacks in Bitcoin price as a strong signal for long-term investment. This statement comes shortly after BTC hit an all-time high of $123,000 last week.

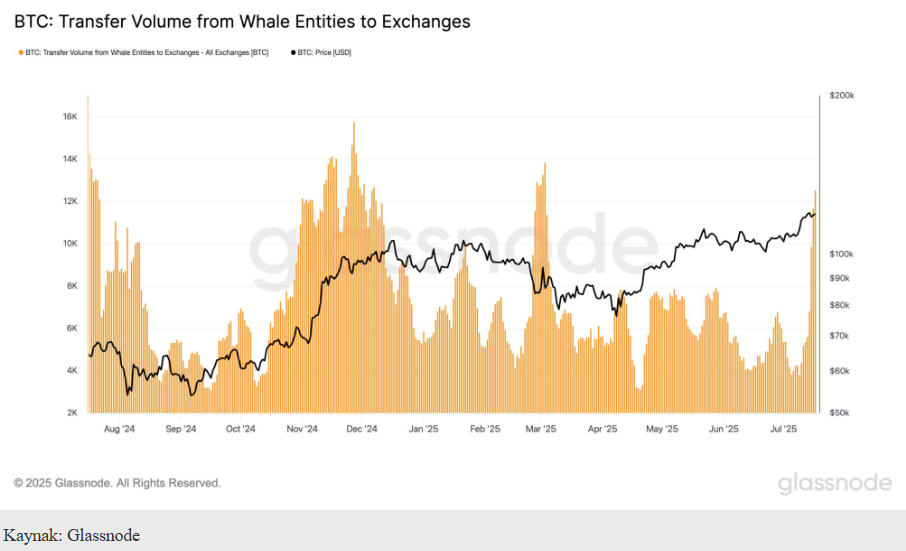

Meanwhile, whales and long-term holders have begun taking profits, causing Bitcoin’s price to retreat to $119,400. Kiyosaki sees such corrections as buying opportunities.

Kiyosaki: “When Bubbles Burst, I’ll Buy Gold, Silver, and Bitcoin”

The U.S. national debt has surpassed $37 trillion. This high level of debt increases market fragility. Treasury yields continue to rise, while the latest CPI figures confirm ongoing inflationary pressure.

BUBBLES are about to start BUSTING.

When bubbles bust odds are gold, silver, and Bitcoin will bust too.

Good news.

If prices of gold, silver, and Bitcoin crash…. I will be buying.

Take care.

— Robert Kiyosaki (@theRealKiyosaki) July 21, 2025

Amid these economic tremors, Kiyosaki is warning investors: “Bubbles are about to burst. When this happens, gold, silver, and Bitcoin will fall in price. But I will be buying during that drop,” he said. He also drew attention to the recent FOMO-driven retail buying following Bitcoin’s rapid rise. In his view, such excessive demand could trigger a short-term price correction. BTC is currently trading in the $118,000–$119,000 range.

Meanwhile, on-chain analytics platform Glassnode reported that the 7-day SMA of whale transfers to exchanges has approached 12,000 BTC. This is among the highest levels recorded in 2025. The platform likened the surge to the profit-taking and capital rotation observed on November 24. This trend aligns with Kiyosaki’s correction forecast and reflects a short-term profit realization behavior among investors.

Short-Term Correction Could Be a Long-Term Opportunity

According to Kiyosaki’s analysis, the current economic outlook is not temporary. He suggests that potential market disruptions could affect not only stock markets but also all asset classes, including cryptocurrencies and precious metals.

Still, Kiyosaki maintains his long-term confidence in Bitcoin. “These kinds of drops are opportunities to build wealth,” he said, advising new investors to prepare rather than panic.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.