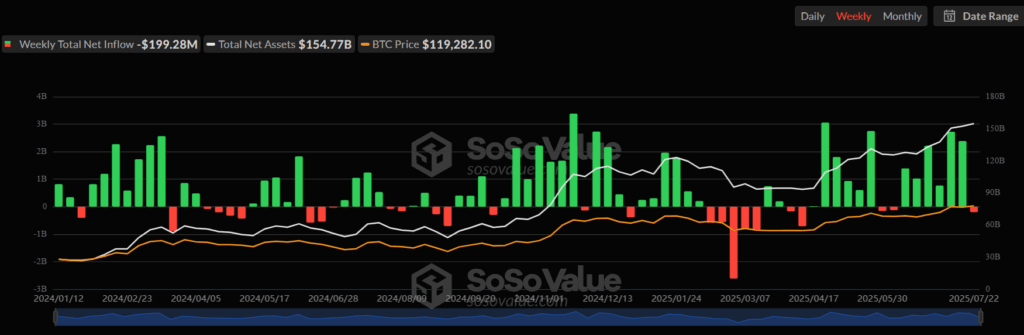

After reaching its record high of $122,054 on July 14, Bitcoin experienced a pullback. Institutional investors withdrew a total of $199 million from US-listed spot Bitcoin ETFs this week. The six-week streak of net inflows has now turned into outflows.

While spot Bitcoin ETFs showed strong accumulation in previous weeks, this trend has recently reversed. This change indicates investors are taking profits. Meanwhile, market volatility suggests a short-term risk of a price decline for Bitcoin.

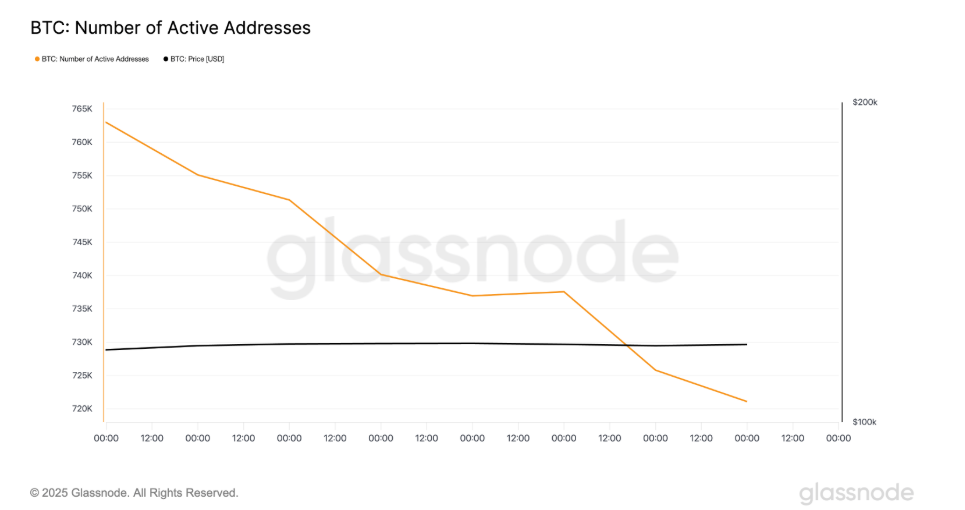

According to Glassnode data, the number of active unique addresses on the Bitcoin network has also decreased. The continuously declining address count over the past seven days signals market stagnation and weak demand. At yesterday’s close, the active address count hit a weekly low of 721,086.

When combined with capital outflows from institutional investors and the drop in individual trading activity, the likelihood of a short-term BTC price correction strengthens.

Spot Bitcoin ETF Outflows Shake Institutional Confidence

Net outflows from Bitcoin ETFs indicate a reduction in institutional investors’ risk appetite. Significant profit-taking occurred especially above the $120,000 price level. Thus, inflows into ETFs that had been supporting the upward trend have turned into outflows.

Institutional capital flows usually reflect market sentiment and confidence, making this development noteworthy for market participants. Additionally, profit realization by professional investors points to an increased perception of market risk.

The decline in active addresses on the Bitcoin network signals a weakening in transaction volume and demand. This decrease stands out as a fundamental metric supporting price movements.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.