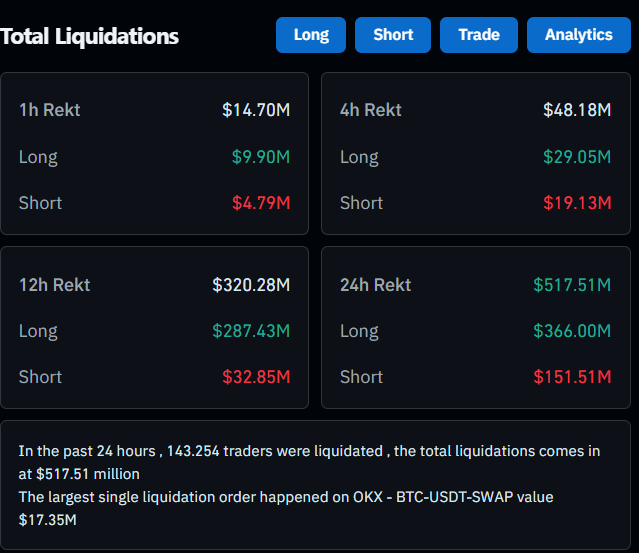

The cryptocurrency markets experienced sharp volatility between July 24–25. According to the last 24-hour data, a total of $517.51 million worth of positions were liquidated. A total of 143,254 traders using leverage were negatively affected by these sharp moves. The high volatility mainly targeted those holding long positions.

Analyzing the liquidations reveals that $366 million of losses came from long positions. Meanwhile, $151.51 million worth of liquidations occurred in short positions. This distribution indicates that the overall market direction reversed unexpectedly. The largest single liquidation happened on the OKX exchange at the BTC/USDT swap pair. In this trade, a $17.35 million position was liquidated. At the time of writing, Bitcoin is trading around $114,760.

Long Positions Took a Major Hit

The data shows that investors holding long positions suffered significant losses. In just the last 12 hours, $287.43 million worth of long positions were liquidated. During the same period, the total loss on short positions was limited to around $32.85 million. This situation reveals that most traders took positions expecting a price increase, but prices moved in the opposite direction.

Meanwhile, the total liquidation over the last 4 hours was recorded at $48.18 million. Of this amount, $29.05 million came from long positions and $19.13 million from short positions. Within the last 1 hour, $14.7 million worth of positions were liquidated. Long traders were again the most affected, with $9.9 million in long positions wiped out, while short traders lost $4.79 million.

What Does This Liquidation Wave Mean?

These liquidations impact not only individual investors but also professional traders. Positions using high leverage are quickly wiped out during sudden price moves. Bitcoin faced intense selling pressure during this period, and other major cryptocurrencies similarly declined.

However, such large liquidations often lead to temporary price relief. Still, investors need to be cautious, manage their leverage levels carefully, and keep stop-loss strategies active. Volatile days like these demonstrate how quickly market sentiment can shift.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.