When Bitcoin miners struggle to cover their operational costs, they are often forced to sell their BTC holdings, creating significant selling pressure.

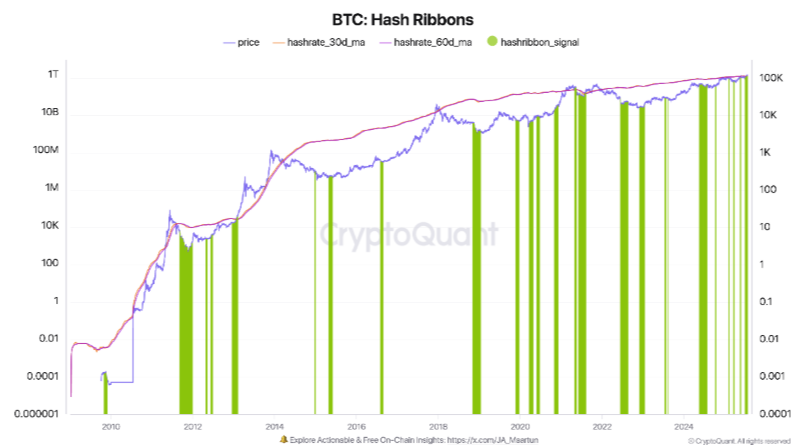

The Hash Ribbons indicator tracks these stressful periods of miner capitulation. The signal, which began on June 25, indicated rising sell pressure and miner stress. However, the recent end of the signal suggests that miners have largely completed their sell-offs and the network hash rate is recovering. This marks a stabilization in mining activity and is considered a positive sign for the market.

Bitcoin Mining Stress and the Hash Ribbons Indicator

According to CryptoQuant, the Hash Ribbons signal is triggered when Bitcoin’s short-term hash rate moving average drops below the long-term average. This reflects miner stress due to increased operational costs. In such situations, miners may temporarily shut down unprofitable operations or reduce activity. To stay afloat, they may need to sell their Bitcoin holdings.

Historically, this signal has marked the end of miner sell-offs and typically precedes bullish market trends. The latest signal reflects a recovery in the hash rate, as the 30-day moving average has now crossed above the 60-day average, signaling a balanced mining environment.

Interestingly, this signal emerged around June 5, when Bitcoin approached the $100,000 mark. CryptoQuant data shows that previous miner capitulation phases, followed by rising hash rates, have often coincided with favorable investment opportunities.

Bitcoin Hash Rate Hits All-Time High: A New Mining Cycle Begins

Bitinfocharts data shows Bitcoin’s network hash rate reached a record 1.0322 zettahash (ZH/s) on July 15. This sharp recovery followed a significant drop to 658 EH/s on June 24. The decline was primarily due to extreme heat and power grid issues in the U.S., forcing some mining operations to pause, especially in heat-sensitive regions.

Some experts speculated that Iran might have contributed to the previous hash rate plunge. Reports indicated that large-scale, state-backed Bitcoin mining operations in Iran caused widespread electricity disruptions. However, this connection remains weak.

In conclusion, the surge in hash rate and the end of the Hash Ribbons signal indicate a major shift in the BTC mining cycle. Miners are now entering a stronger and more sustainable production phase, potentially setting the stage for a market recovery.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates