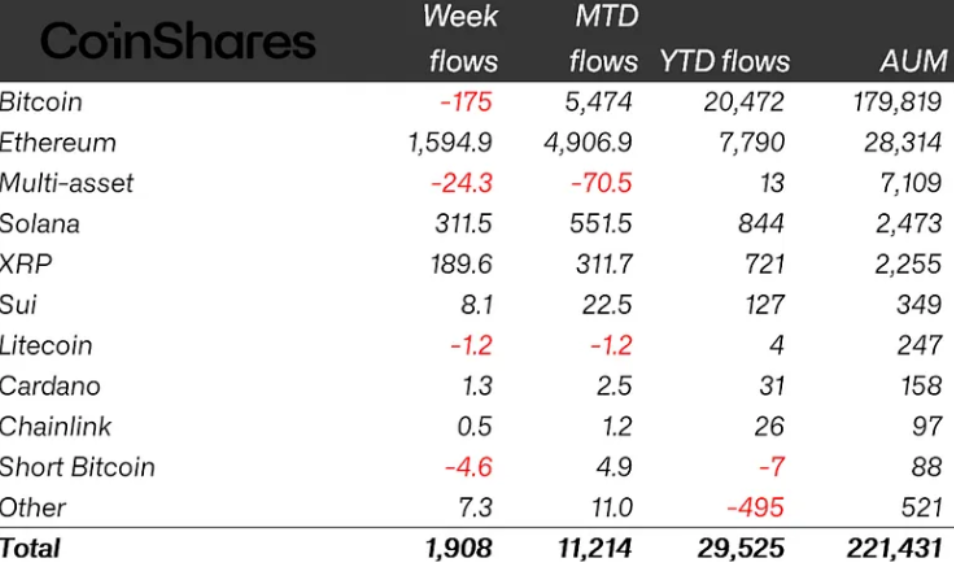

Crypto asset investment products ended last week with a net inflow of $1.9 billion. According to a new report by CoinShares, this marks the 15th consecutive week of positive flows.

Ethereum ETPs were the standout performers, recording $1.59 billion in inflows — the second-largest weekly influx in their history. This performance stands out as one of the most notable crypto investments of the year so far.

Meanwhile, Bitcoin ETPs closed the week with $175 million in outflows after 12 consecutive days of inflows. CoinShares Head of Research James Butterfill attributed this divergence to rising expectations around altcoin ETFs.

Following Ethereum, Solana and XRP were the week’s other top gainers, attracting $311.5 million and $189.6 million, respectively. However, some alternative digital assets like Litecoin and Bitcoin Cash saw modest outflows.

Bitcoin Funds Weaken While iShares Maintains the Lead

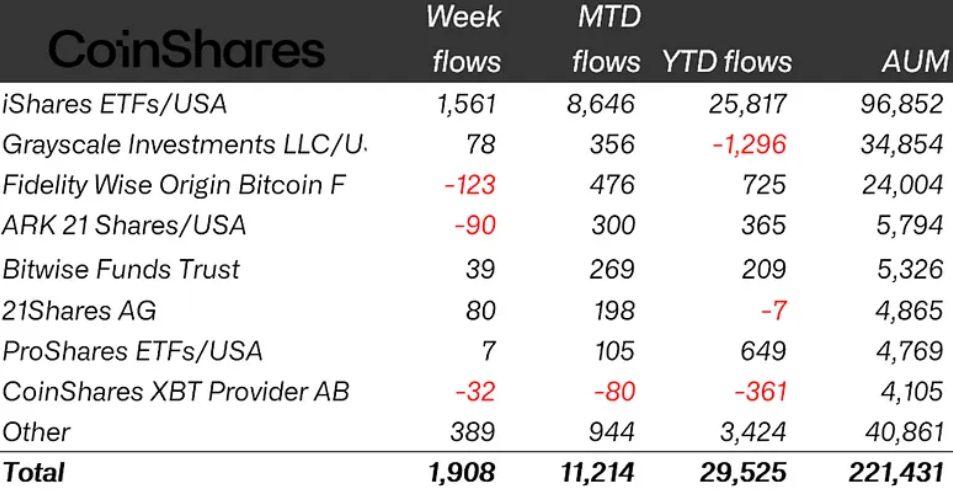

Despite a 57% drop compared to the previous week’s record $4.4 billion inflow, overall market appetite remained strong. iShares crypto ETPs by BlackRock led the week with $1.56 billion in inflows.

Fidelity funds saw $123 million in outflows, while ARK Invest recorded $90 million in outflows. Europe-based 21Shares followed iShares closely with $80 million in inflows, and Grayscale drew $78 million.

Despite $356 million in inflows year-to-date, Grayscale remains in the red with $1.3 billion in net outflows. In contrast, BlackRock captured $25.8 billion in inflows so far in 2025 — representing 87.5% of the year’s total crypto fund inflows.

These trends not only reflect the current state of the crypto market but also mirror investors’ anticipation of ETF approvals. According to Butterfill, these increases are not indicators of an altcoin season but rather a pricing-in of potential ETF launches.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.