President Donald Trump announced new tariffs that triggered a sharp sell-off in cryptocurrency markets. Bitcoin dropped to $114,250 on Coinbase during the Asian session, hitting its lowest level in three weeks. TradingView data shows BTC last traded at this level on June 11.

Following the decision, BTC broke below its three-week horizontal support channel. If the price fails to recover, the next technical support level stands near $111,000. This decline reflects a 6.5% drop from the $122,800 all-time high recorded on July 14.

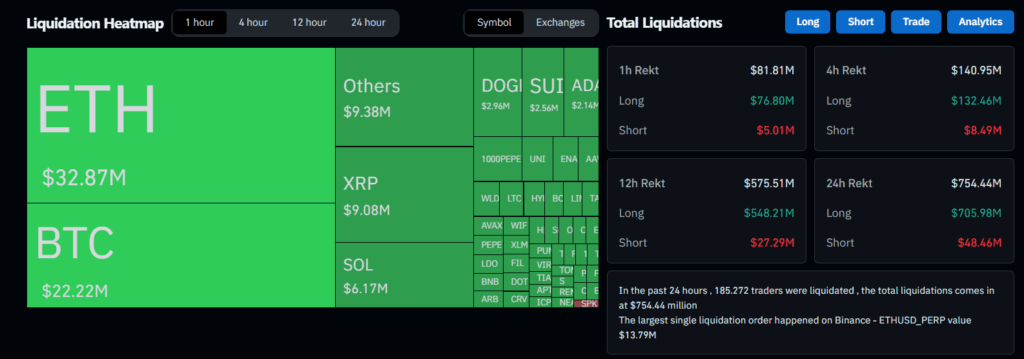

In the past 12 hours alone, $110 billion exited spot cryptocurrency markets. Data from CoinGlass reveals that 158,000 investors liquidated positions worth $630 million in total, mostly from long trades.

Investor Nervousness: Sharp Sales in Stocks and Cryptos

With the signed decree, Trump raised tariffs on Canada from 25% to 35%. Additionally, countries like South Africa, Switzerland, Taiwan, and Thailand face new tariffs ranging from 19% to 39%. Meanwhile, trade agreements with the European Union, Japan, South Korea, and the United Kingdom gained official status.

These developments pressured not only cryptocurrencies but also stock markets across Asia. Many investors interpret these sudden policy changes as temporary corrections rather than structural threats.

Henrik Andersson, Chief Investment Officer at Apollo Capital, said, “Seeing a correction amid tariff uncertainty is natural.” Meanwhile, Nick Ruck, Director at LVRG Research, described this week’s drop as a mix of tariff deadline fears and broader macroeconomic uncertainty. In other words, multiple factors drive the current market pressure.

Bitcoin Achieves Record Monthly Candle Close in July

Despite these pressures, Bitcoin closed July at $115,784, marking its highest monthly candle to date. However, this close remains below the massive $26,000 gain in November when Trump’s election victory pushed markets sharply higher. Trump won the U.S. elections at that time, which strongly boosted the markets.

A potential trade deal with China could boost investor confidence. This development might trigger a new market recovery. For now, investors closely monitor macro developments and key technical levels.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates