The latest Producer Price Index (PPI) and jobless claims data from the U.S. have weakened market expectations for a rate cut. The released figures revealed that inflationary pressures remain above forecasts, reducing the likelihood of the Fed delivering an aggressive rate cut in the near term.

Data Above Expectations

-

U.S. Initial Jobless Claims: 224K (Forecast: 225K, Previous: 226K)

-

Annual PPI: 3.3% (Forecast: 2.5%, Previous: 2.3%)

-

Monthly PPI: 0.9% (Forecast: 0.2%, Previous: 0.0%)

The fact that both annual and monthly PPI came in significantly higher than expected has reinforced the market perception that “inflation is still not under control.”

Decline in Rate Cut Probabilities

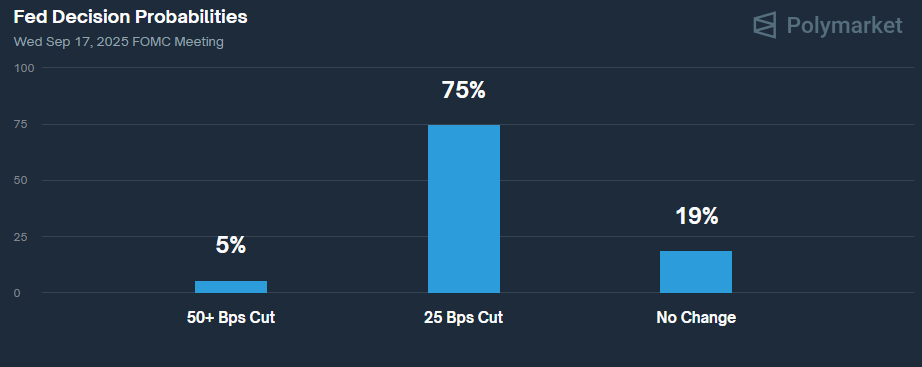

According to Polymarket data, rate cut probabilities for the September 17, 2025 FOMC meeting are as follows:

-

50+ bps cut: 5%

-

25 bps cut: 75%

-

No change: 19%

These figures show that after the PPI release, the likelihood of a strong 50 basis point cut has weakened considerably, creating a more cautious outlook in the markets.

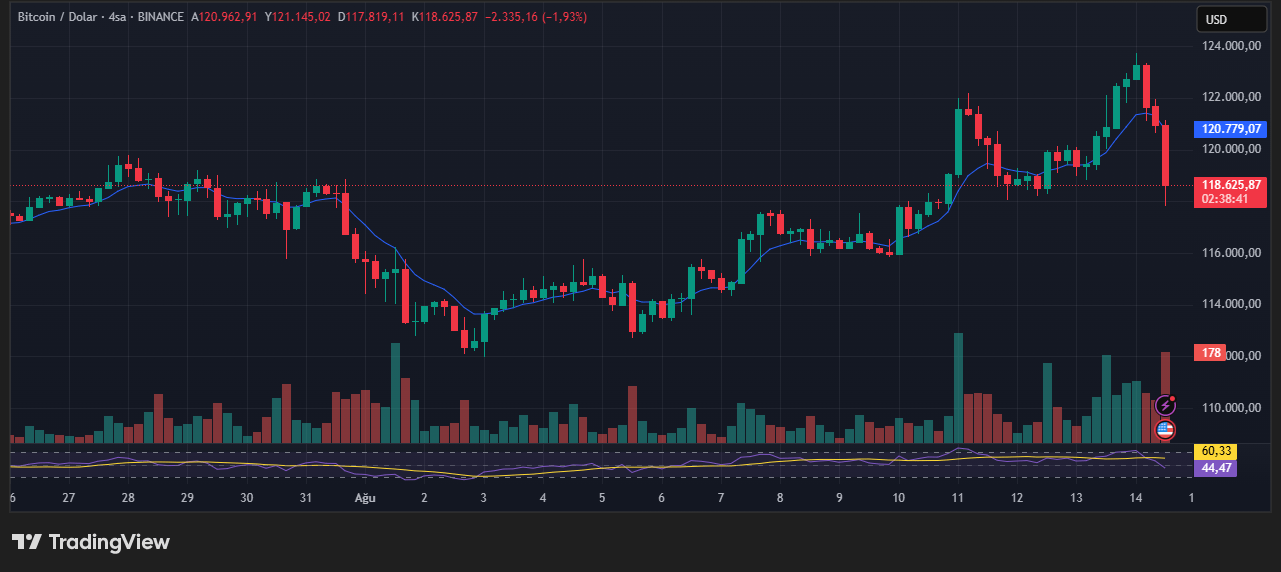

Sharp Drop in Bitcoin

This negative macroeconomic sentiment also spilled over into Bitcoin prices. The leading cryptocurrency fell 3.51%, dropping below $119,000. Rising inflation data and the decreased likelihood of a more dovish Fed stance have increased selling pressure on risk assets.

Short-term market volatility is expected to continue, with investors closely monitoring both inflation indicators and statements from Fed officials.

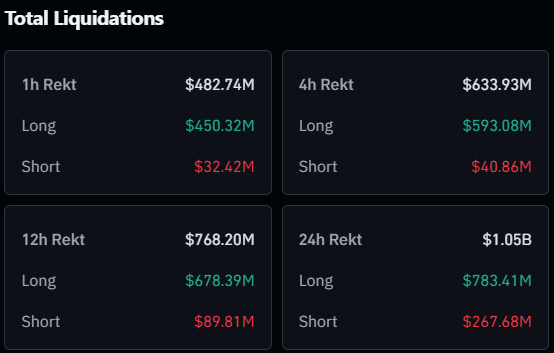

$1.05 Billion in Positions Liquidated in the Last 24 Hours!

In the past 24 hours, heightened volatility in the crypto market has led to more than $1.05 billion in liquidations. Of this, $781.97 million came from long positions and $270.19 million from short positions. This highlights the severe losses for leveraged traders and the sharp moves occurring in both directions.

U.S. Stocks Open Lower!

U.S. equities started the day slightly in the red. At the open, the Dow Jones index was down 0.07%, the S&P 500 fell 0.30%, and the tech-heavy Nasdaq slipped 0.31%. This weak opening reflects investors’ cautious stance regarding economic data and rate cut expectations.

This content is for informational purposes only and does not constitute investment advice. Markets carry high risks, and you should always conduct your own research before making investment decisions.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.